A total of 1.82 million mt of iron ores was traded for the week ended Nov 13, up almost 60% week-on-week as compared to the 1.15 million mt recorded last week.

The higher intake of iron ore was due to better steel prices and margins that encouraged mills to produce more steel for the catch-up construction activities before the winter season.

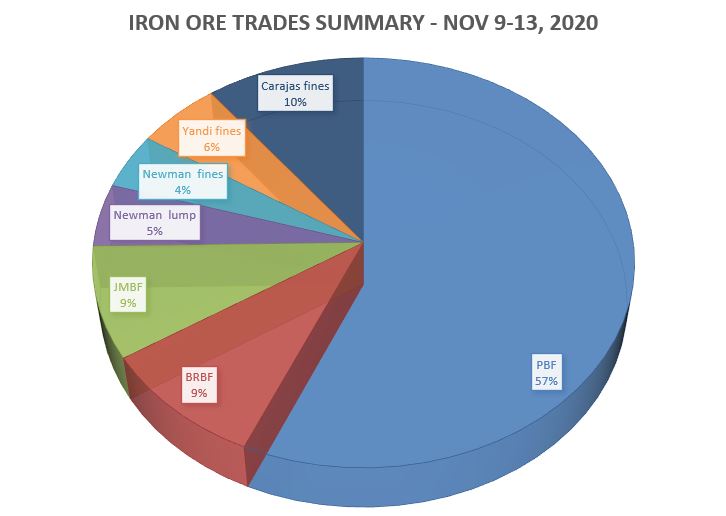

PBF became the most popular iron ore products traded for the week at 57%, then seconded by Carajas fines at 10%, and finally BRBF came in third at 9%.

More usage for Australian medium grade fines

More mills were seeking more for medium grade fines like PBF, due to its cost effectiveness as compared to high-low grade fines combination.

Some mills also seek for low grade iron ore fines like Yandi fines to blend with medium grade fines for cost saving, amid the high steel margins.

In the meantime, the price spread between high grade fines and medium grade fines had narrowed due to Vale’s huge offering of spot cargoes in the market.

Lump over pellet for winter output cut season

Lump demand had improved due to its cost efficiency over pellets, but lump premium stayed flattish due to oversupplied market.

The demand for lump was due to new round of sintering cut in Tangshan as well as restriction of truck transportation issued on Nov 8 to improve air quality.

Some end-users then prefer to purchase on mid-grade and high-grade fines as they pushed for output efficiency and to comply with new round of environmental curbs for winter season.