A total of 1.37 million mt of iron ores was traded for the week ended Nov 27, almost halved or down 48.88% week-on-week, as compared to 2.68 million mt recorded last week.

The lower transaction volume was due to colder weather in northern China that resulted in lesser construction activities and reduced the intakes for iron ore cargoes.

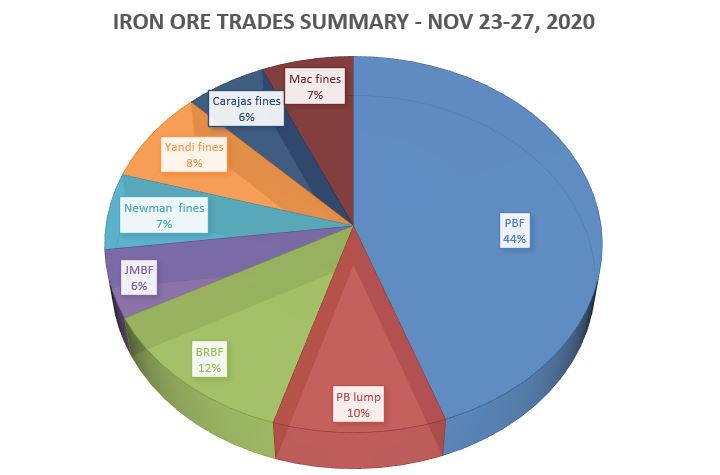

PBF accounted most of the transacted iron ore products for the week at 44%, then followed by BRBF at 12%, and finally PB lump came in third at 10%.

Medium grade fines remain the mainstay

Due to the high steel margins, most of the Chinese end-users prefer to procure medium grade fines, like PBF, Mac fines and Newman high grade fines, while low grade fines like Indian fines were at the lower priority.

There was also interests for high grade ores like Carajas fines in the near term, due to their low silica and alumina content.

Besides, the spread between 65% and 62% Fe indexes had narrowed due to the abundant supply of domestic concentrates produced previously by Chinese producers.

Pellet premium to rise on tighter supply

The iron ore pellet premium is expected to rise on tight near-term supply, especially for first quarter contract next year, according to Platts.

As India is likely to cut pellet exports to support its domestic market of rising steel and pig iron rates, while European steel-makers had increased usage of pellets since August and had little excess to offer to the spot market.

However, there might be some easing of the tight supply from Brazilian miner, Vale as it pledged to supply around 30-35 million mt of pellets in 2020, but down from usual annual pellet supply of 60 million mt.

Meanwhile, there was concerns on the upcoming rainy season in Brazil that may affect shipments, plus Vale’s pellet complex in Samarco has yet to confirm on restarting its pellet shipments in December, after a five-year suspension.