A total of 1.885 million mt of iron ore was exchanged hands for the week ended Sep 4, an increase of 52.37% as compared to the 1.237 million mt recorded last week.

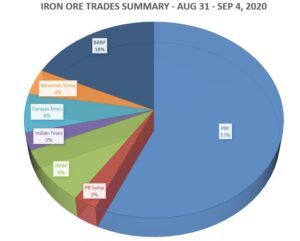

Medium grade fines like Pilbara Blend fines (PBF) accounted over half of the transacted trades for this week at 57%, as compared to last week, when low grade fines were the dominant force.

PBF’s huge market share was later followed by BRBF at 18% and then Jimblebar fines at 9% for the Aug 31 – Sep 4 week.

This huge buying interests for the PBF then pushed the iron ore prices to a six-year high as Platts assessed the 62% Fe Iron Ore Index over the $130/mt mark on Thursday.

Historical high iron ore prices

China’s strong steel demand were behind the iron ore prices coming to a six year high, as construction activities normally peaked for the Sep-Oct season.

There were also speculative buying activities among traders for medium grade fines that pushed up iron ore prices further, especially for October loading cargoes.

However, some market participants expect some pullback from recent price upticks due to some easing of port inventory which recorded at 113.74 million mt on Friday, up 635,100 mt week-on-week.

Bullish September for steel demand

However, China’s steel demand shown no sign of stopping, and the bullish run may well carry over the Sep-Oct period.

Some trade sources estimated higher vehicle sales in September, as China Association of Automobile Manufacturers (CAAM) just recorded higher passenger vehicles’ sales at 2.18 million units for August, up 11.3% year-on-year.

The heavy truck sales also shown some promise as it totaled to 128,000 units in August, up 75% on-year due to growing construction activities.

Besides, China’s construction activities are expected to accelerate as Beijing policymakers introduce more new infrastructure projects and redevelopment of old residential areas to stimulate the economy.