A traumatic start to the year for U.S. steel makers may now be behind them after some of the largest producers offered positive outlooks for the rest of the year.

Non-residential construction in the U.S has remained resilient compared to the consumer sector in recent months. With it looking increasingly like the worst of the pandemic is behind the U.S, the expectation of economic growth on the back of stimulus can only be perceived as positive to those in the steel sector.

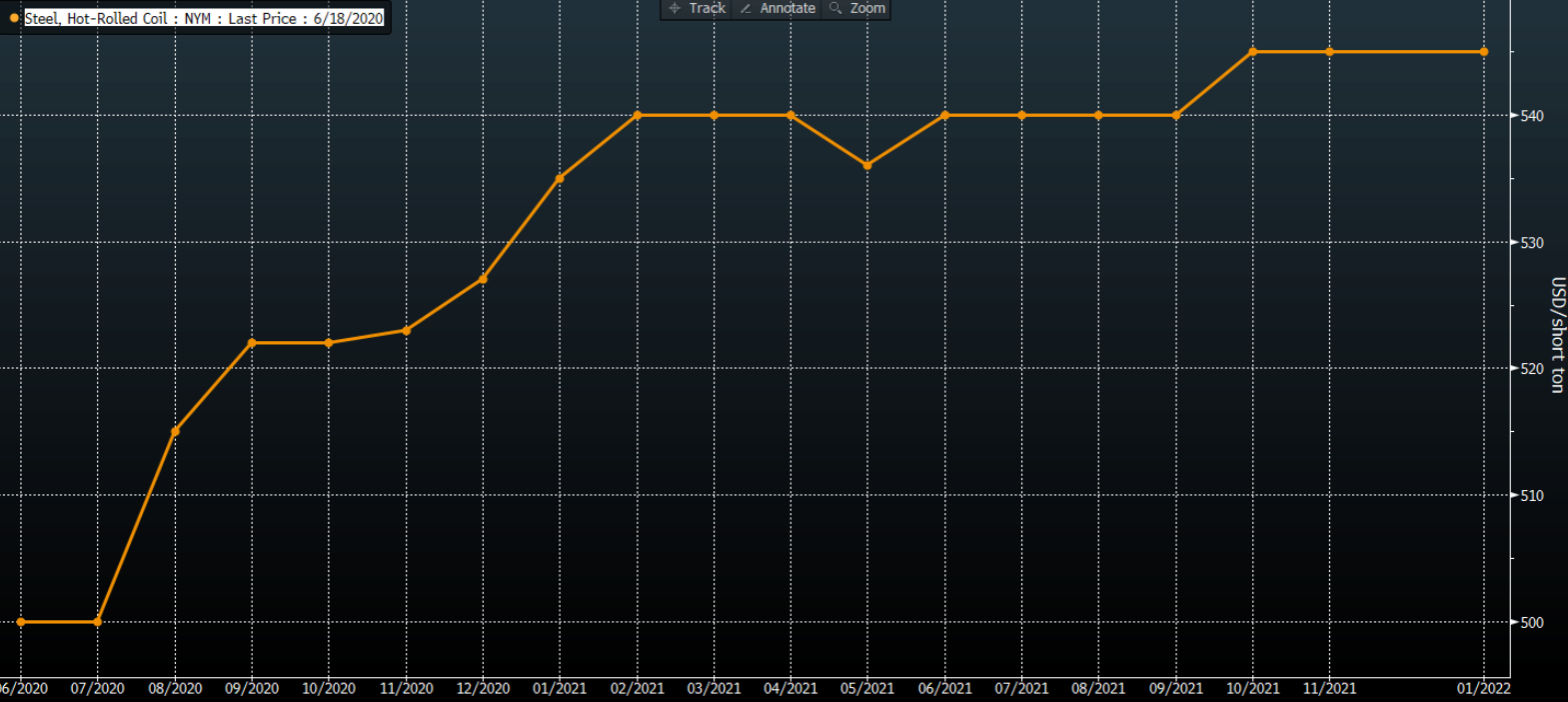

U.S. HRC futures have moved lower in recent weeks with the July futures down nearly 10% since the high on 21-05-20, from USD 544 to USD 499 a ton. However, further down the curve futures pricing has performed better with the December futures down only 3.2% from USD 548 to USD 527.

Bloomberg commodity curve analysis U.S. Midwest Domestic Hot-Rolled Coil Steel Index Futures

The futures curve would suggest steel makers have reason to be optimistic with industry leader Nucor Corp reporting to Bloomberg that automotive related steel demand is showing a strong rebound.

Meanwhile in China, Rebar futures have been positively booming, having rallied 17.5% since early April.

China were the first to catch, and the first to recover from the Pandemic and this has been reflected in the rebar price. Government stimulus has seen economic expansion and record steel output as the worlds second largest economy looks to shake off the effects of the pandemic.

China’s Vice Premier Liu He said China’s prudent monetary policy should be more flexible, and it should strengthen counter-cyclical adjustments in economic management, in prepared remarks delivered on Thursday. Liu’s speech also said that China will keep aggregate policy appropriate and keep liquidity reasonably ample. This speech was delivered at a forum in Shanghai by Yi Huiman, the head of China’s securities regulator.

Like the Chinese government, the U.S Federal Reserve has the largest stimulus package in history ready to pump nearly two trillion into their economy. This supports the curve analysis as shown in the chart and alongside positive talk from the industry would seem correct. Being cautiously optimistic, due to the tricky path ahead, would seem prudent. However, being frugal doesn’t bring economies out of a recession and certainly doesn’t benefit the U.S steel industry. (FIS)