Goldman Sachs expected more steams for iron ore rally, despite its prolonged bullish run for three-consecutive year.

At first the bull run was triggered by supply shock from Brazil’s Vale, but the rally had matured to a more demand-oriented market, boosted by various governments’ economic stimulus packages.

“Iron ore has become the poster child of the revenge of old economy,” said Nicholas Snowdon, the Head of Base metals and Bulks Research GIR, Goldman Sachs during the keynote speech of Singapore Iron ore Forum 2021 held on July 13.

Revenge of old economy

The coined “old economy” referred to industries like mining, utilities, and general industrial sector, which recorded low capex growth since 2019.

However, the investment in these old economy sector had accelerated during 2020 and likely after the post-Covid era, as more states’ policies focused on social needs instead of financial stability.

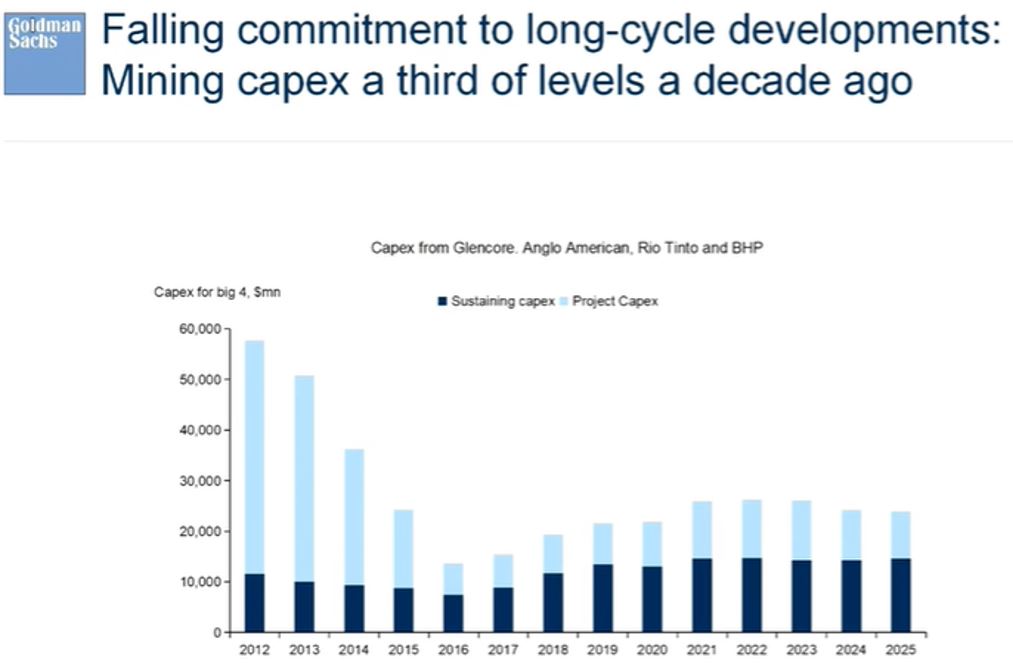

According to Goldmans, the capex for mining sectors was one-third lower than a decade ago, with many major miners falling to commit to long cycle development.

Shift to regional supply chain rather than global

The post-Covid world will also be likely to experience a breakaway from the global supply chain to more regional one, which will be more metal-intensive one.

“There will be no more one single manufacturing hub concentrated in China, but with many other regional manufacturing hubs,” Snowdon predicted.

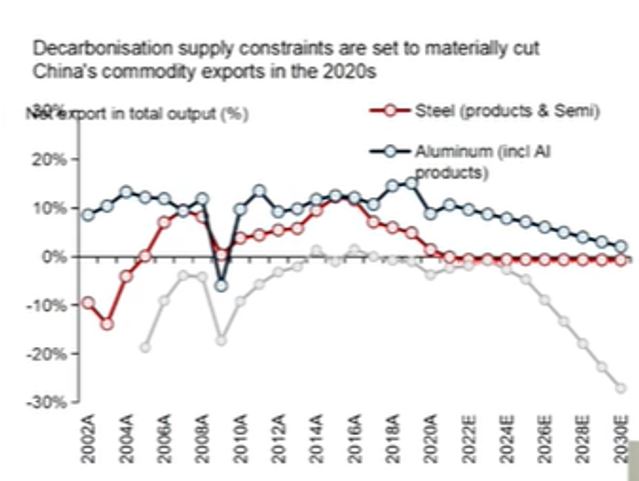

Besides, China’s cheap power and labour advantage had diminished over time to compete with other developing countries, while China is expected to increase its spending on green initiatives for decarbonization that might constrain Chinese exports in the 2020s.

Super cycle or sustainable market?

Goldmans foresaw a more sustainable market in the post-Covid world, with greater emphasis on decarbonization to comply with stricter emission regulations.

Being the leading steel demand country, China is expected to see sustained steel price growth, though there were signs of deceleration, while the rest of the world showed greater appetite for steel demand.

There will also be more versatile supply chains, as the world learnt its lesson from the Covid pandemic with the reshaping of the global supply chain and remapping of commodity flows to diversify risks.