Verdict:

• Short-run Neutral.

Macro:

• Canada cut interest rate by 25 bps to 4.75%, became the first country to cut interest rate in G7.

• EIA report indicated that US crude oil inventories up 1.233 million barrels to 456 million barrels, refreshed new high since March 31st, 2023.

Iron Ore Key Indicators:

•Platts62 $106.35, -0.45, MTD $107.60. The physical iron ore saw support on both price and volume after the drop on futures for two weeks. Trader bought 80,000mt MACF at July index – $5.1 discount. In addition, there were fixed trades on MACF and BRBF as well.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 5th)

• Futures 114,447,800 tons(Increase 364,100 tons)

• Options 158,223,600 tons(Increase 3,529,900 tons)

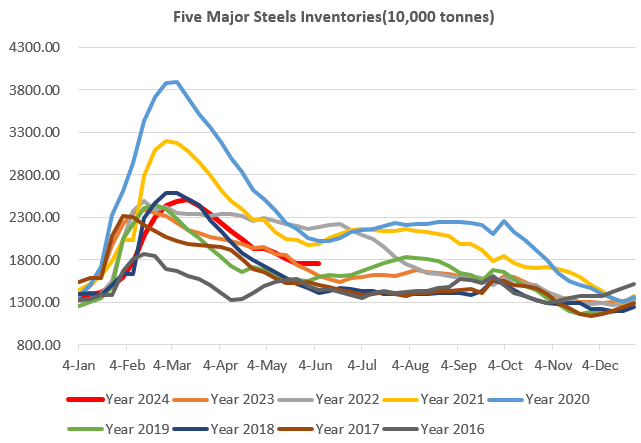

Steel Key Indicators:

• China Tangshan average billet cost 3438 yuan/ton, down 28 yuan/ton, average loss at 8 yuan/ton.

Coal Indicators:

• Some physical traders expected a price cut on physical coke price in China in mid-June. Previously, coking coal auctions in China saw lower bids.