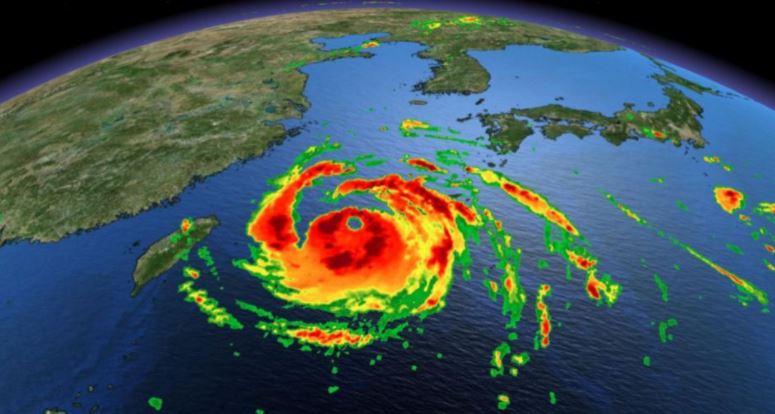

Capesize freight rates started to strengthen for the week with market concerns over port congestion in China, typhoon threats in the Far East and high iron ore prices.

However, the firmer rates may reverse at any instance after the typhoon left with little shipping disruption to the East Asia region.

In view of this weakness, the Baltic Dry Index (BDI) dipped by 1.06% day-on-day to 1,488 readings on Monday.

Firmer Pacific freight rates

The healthy shipping demand in the Pacific market saw three major miners, Rio Tinto, BHP and FMG to seek for vessels in the key west Australia to China route for mid-Sep laycans.

FMG was heard to fix a vessel moving iron ore from Port Hedland to Qingdao for mid-Sep laycan in the low $8/wmt.

Going forward, trade participants expect firmer rates over near term due to the gradual easing of port congestion in China.

In contrast, there was less trading activities in the Atlantic market as many participants were committed in seeking for second-half September laycan, while some were in talks for October laycans.

Bunker prices rebound on better demand

VLSFO prices rebounded by $8 day-on-day to $353/mt at the port of Singapore, following the firmer crude oil prices movement.

Chinese oil demand remained strong in compliance to Phrase 1 trade deal with the US, as well as quick economic recovery from the coronavirus pandemic.

Chinese oil demand was estimated at 14.16 million barrel per day (bpd) in July, up 16.7% on-month and higher than 12.83 million bpd for the same period last year.

As such, the Brent crude oil price moved higher toward $46 per barrel, while the WTI crude headed higher toward $43 per barrel.