Good morning all. Brent crude futures fell 10 cents, or 0.2%, to $42.98 a barrel by 0417 GMT. U.S. WTI crude futures dropped 12 cents, or 0.3%, to $40.50 a barrel, holding to the narrow range of the past few weeks. The American Petroleum Institute (API) reported crude stockpiles rising by 2.05 million barrels last week, with Cushing supplies expanding for the first time since early May. On the other hand, gasoline and distillate inventories fell more than expected. Furthermore, the US Energy Information Administration in its monthly report published July 7 boosted its 2020 outlook for crude futures buoyed by demand recovery, whilst US oil production is expected to fall by 600,000 barrels per day (bpd) in 2020. In detail, Brent prices are seen at an average of $40.50/b in 2020 and $49.70/b in 2021, while WTI prices to average $37.55/b in 2020 and $45.70/b in 2021.However, the market is mixed as optimism about China’s quick economic rebound is offset by persistent worries that the rising global coronavirus cases, surpassing the 3 million milestone just the United States, together with the easing of OPEC+ cuts in August will stall a recovery in fuel demand. According to Reuters Abu Dhabi National Oil Co. (ADNOC) is planning to increase crude exports by as much as 300,000 barrels a day in August. Meanwhile, Libya’s National Oil Corp. said that current tensions can potentially halve production levels for the coming years.

MARKETS NEWS:

* Europe’s Oil Refiners Eye Relief From Overdose of Asian Diesel

* Iraq to Resume Oil Exports to Jordan This Week, Zawati Says

* Oil-Sands Explorers Restore Some 20% of Shut-in Crude Production

* API Reports U.S. Crude Stockpiles Rose 2.05M Bbl Last Week

* EIA Lowers 2020 Global Oil Supply Outlook, Lifts Demand Estimate

* EIA Raises 2020 U.S. Crude Output and Oil Demand Forecasts

* Colombia Crude Exports Seen Up in July at 511.3K B/d: Program

* Stavanger Falcon Oil Tanker Reaches China From Vancouver, B.C.

* Argentina’s Refineries Process Least Oil on Record on Virus

* North Sea Crude Floating Storage Almost Dissipates in Europe

* Husky Has ~40K B/D of Oil Shut, Down From 80k B/D Earlier in Yr.

* U.A.E to Boost Oil Exports 300K B/d as OPEC Cuts Ease: Reuters

OTHER NEWS:

* Venezuela Assembly Names One New Member of PDVSA Ad Hoc Board

PHYSICAL CRUDE NEWS:

* ASIA: ZenRock to Wind Down by August; Medium-Heavy Sour

* LATAM: Venezuela Running Dry; Argentina Refining Slump

* US/CANADA: N.D. May Never Boom Again With DAPL Shutdown

* NSEA: BP Bids Forties Higher; Floating Storage Unwinding

* MED: Shell Bids Urals Higher; Siberian Light Cargo Dropped

* WAF: Four VLCCs Booked to Asia; Key Tenders Due Soon

OIL PRODUCT NEWS:

* U.S.: Shell Eyes Convent Sale in Downstream Retreat

* EUROPE: Schiphol Air Traffic Up; Russia Syzran Fire

* ASIA: Dirty Diesel Discount Narrows; ZenRock

ECONOMIC EVENTS: (Times are London.)

* 3:30pm: EIA weekly U.S. inventory report

* BTC loading program for August

* Spain publishes its crude import data for May

* OMV AG publishes sales figures

* Genscape weekly ARA crude inventory report

ANALYST COLUMNS:

* Remaining Vigilant as Oil-Demand Risks Persist With Covid-19

* Angola’s Oil Output Has Peaked, Will Decline 28% by 2030: Rystad

* Challenges Remain on Slower Bounce to Oil Earnings, Cash Flow

* BNP Paribas Raises Oil Forecasts, Expects Further Recovery

OTHER FINANCIAL MARKETS:

* Global Stocks Mixed Amid Ongoing Chinese Gains: Markets Wrap

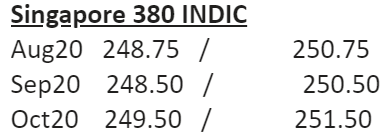

Singapore 380 INDIC

Aug20 248.75 / 250.75

Sep20 248.50 / 250.50

Oct20 249.50 / 251.50

Nov20 250.75 / 252.75

Dec20 252.25 / 254.25

Jan21 253.75 / 255.75

Q4-20 250.75 / 252.75

Q1-21 254.50 / 256.50

Q2-21 256.25 / 258.25

Q3-21 257.25 / 260.25

CAL21 254.50 / 260.50

Rotterdam 3.5% INDIC

Aug20 234.75 / 236.75

Sep20 232.50 / 234.50

Oct20 230.25 / 232.25

Nov20 229.50 / 231.50

Dec20 230.25 / 232.25

Jan21 232.25 / 234.25

Q4-20 230.00 / 232.00

Q1-21 233.50 / 235.50

Q2-21 236.50 / 238.50

Q3-21 238.00 / 241.00

CAL21 235.50 / 241.50

Singapore VLSFO 0.5% INDIC

Aug20 315.00 / 320.00

Sep20 319.50 / 324.50

Oct20 323.75 / 328.75

Nov20 327.50 / 332.50

Dec20 331.00 / 336.00

Jan21 334.25 / 339.25

Q4-20 327.50 / 332.50

Q1-21 337.00 / 342.00

Q2-21 343.50 / 349.50

Q3-21 349.25 / 355.25

CAL21 346.00 / 352.00

Rott VLSFO 0.5% INDIC

Aug20 299.75 / 304.75

Sep20 304.00 / 309.00

Oct20 307.50 / 312.50

Nov20 310.00 / 315.00

Dec20 312.00 / 317.00

Jan21 315.50 / 320.50

Q4-20 309.75 / 314.75

Q1-21 318.00 / 323.00

Q2-21 324.00 / 330.00

Q3-21 329.00 / 335.00

CAL21 326.00 / 332.00

Sing 10ppm GO INDIC

Aug20 48.93 / 49.07

Sep20 48.95 / 49.15

Oct20 49.23 / 49.43

Nov20 49.50 / 49.70

Dec20 49.78 / 49.98

Jan21 50.17 / 50.37

Q4-20 49.45 / 49.75

Q1-21 50.53 / 50.83

Q2-21 51.56 / 51.86

Q3-21 52.57 / 52.87

CAL21 51.89 / 52.29

ICE Gasoil 10ppm INDIC

Aug20 370.79 / 372.79

Sep20 374.29 / 376.29

Oct20 376.93 / 378.93

Nov20 378.65 / 380.65

Dec20 380.83 / 382.83

Jan21 383.91 / 385.91

Q4-20 378.80 / 380.80

Q1-21 385.69 / 387.69

Q2-21 394.51 / 396.51

Q3-21 404.78 / 406.78

CAL21 398.24 / 400.24

Rott Hi5 Sing Hi5

Aug20 67 68

Sep20 73 73

Oct20 79 76

Nov20 82 78

Dec20 83 80

Jan21 85 82

Q4-20 81 78

Q1-21 86 84

Q2-21 89 89

Q3-21 93 94

CAL21 91 92

UK number: +44 (0)207 090 1134

Shanghai number: +86 (0)21 63012568

|

Luke Longhurst

Ricky Forman

|

Chris Hudson

Jessie Deng |