Good morning all. Brent crude fell 26 cents, or 0.6%, to $42.82 a barrel by 0545 GMT, after earlier skidding to a session low of $42.21. U.S. oil was down 38 cents, or 0.9%, at $40.35 a barrel, having dropped to a low of $39.76. Prices dropped last night after Navarro told Fox News in an interview that the trade deal with China was “over”, linking the breakdown in part to Beijing not sounding the alarm earlier about the outbreak of the coronavirus. These worries were calmed by assurances from the President that the agreement was still on. Prices this morning have hit a two week high, as the market pushed over the $43 mark. Part of this has been cause by Russia, one of the world’s largest producers, in curbing its exports to multi-year lows, helping boost demand for other European grades.

MARKETS NEWS:

* Oil Shock Upends State That Had Become Shale’s Newest Powerhouse

* Third of U.S. Shale Near Technical Insolvency, Deloitte Says

* Los Angeles Jet Fuel Rises With Airline Picture Getting Rosier

* Urals Baltic Crude Exports Set at 9 Cargoes in Early July: Plan

* Nigeria Forcados Oil Loadings to Drop to 218K B/D in Aug.: Plan

* Kuwait: Khafji Oil Field Shared With Saudis Is to Restart

* U.S. Gasoline Imports From Europe Drops to 4-Week Low: Customs

* Sonangol Allocates 13 August Oil Cargoes to Term Buyers in Asia

* Benchmark VLCC Rates Extend Drop; WAF-Europe Clean Tankers Jump

OTHER NEWS:

* Oil Rebound Is Foiling Most Bullish U.S. Gas Market in Years

* Russian Oil Gets Defense Against Drones From Former Secret Lab

* Pemex Reports 142 Worker Deaths Due to Covid-19

* Co-op Saskatchewan Refinery Union Workers Ratify Tentative Deal

* Woodside Shows Interest in Chevron’s North West Shelf Stake

* Australia Tax Agency Updates Excise Tax Rates on Fuel Products

* Total to Solvay Pursue Chemical Divestments as M&A Returns

PHYSICAL CRUDE NEWS:

* ASIA: Buyers Look to U.S. on OPEC Uncertainty; Low Margins

* LATAM: Petrobras’s Acu Oil Deal; Trump, Maduro; Xan Coban

* US/CANADA: Shale’s Decline to Curb U.S. Pipe Build-out

* NSEA: Litasco, Total and Mercuria Bid; Forties Forecast

* MED: Russia to Cut Early July Urals Exports; Refinery Halt

* WAF: Nigeria to Cut Forcados Exports; Sonangol Allocations

OIL PRODUCT NEWS:

* U.S.: PBF Keeps FCC at Martinez Shut Another Week

* EUROPE: Flow to U.S. Drops; Gunvor Antwerp Mothball

* ASIA: Refiners’ Margin Pain; China Exports Surge

ECONOMIC EVENTS: (Times are London.)

* 9:30pm: API weekly report on U.S. oil inventories

ANALYST COLUMNS:

* Shale’s Decline to Curb U.S. Pipe Build-out, Morningstar Says

OTHER FINANCIAL MARKETS:

* Asia Stocks Climb After Trade-Headline Whipsawing: Markets Wrap

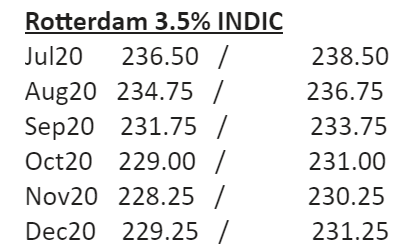

Rotterdam 3.5% INDIC

Jul20 236.50 / 238.50

Aug20 234.75 / 236.75

Sep20 231.75 / 233.75

Oct20 229.00 / 231.00

Nov20 228.25 / 230.25

Dec20 229.25 / 231.25

Q3-20 234.25 / 236.25

Q4-20 228.75 / 230.75

Q1-21 231.75 / 233.75

Q2-21 234.50 / 237.50

CAL21 233.75 / 239.75

Singapore 380 INDIC

Jul20 241.25 / 243.25

Aug20 245.25 / 247.25

Sep20 246.75 / 248.75

Oct20 247.25 / 249.25

Nov20 248.00 / 250.00

Dec20 249.25 / 251.25

Q3-20 244.25 / 246.25

Q4-20 248.00 / 250.00

Q1-21 251.50 / 253.50

Q2-21 253.25 / 256.25

CAL21 253.25 / 259.25

Rott VLSFO 0.5% INDIC

Jul20 295.50 / 301.50

Aug20 300.00 / 306.00

Sep20 304.00 / 310.00

Oct20 307.25 / 313.25

Nov20 310.00 / 316.00

Dec20 312.25 / 318.25

Q3-20 299.75 / 305.75

Q4-20 309.75 / 315.75

Q1-21 317.75 / 323.75

Q2-21 323.00 / 331.00

CAL21 326.75 / 334.75

Singapore VLSFO 0.5% INDIC

Jul20 313.00 / 319.00

Aug20 320.00 / 326.00

Sep20 325.25 / 331.25

Oct20 329.75 / 335.75

Nov20 333.25 / 339.25

Dec20 336.00 / 342.00

Q3-20 319.50 / 325.50

Q4-20 333.00 / 339.00

Q1-21 342.50 / 348.50

Q2-21 349.00 / 357.00

CAL21 350.25 / 358.25

Sing 10ppm GO INDIC

Jul20 48.67 / 48.81

Aug20 48.49 / 48.69

Sep20 48.86 / 49.06

Oct20 49.29 / 49.49

Nov20 49.65 / 49.85

Dec20 49.99 / 50.19

Q3-20 48.60 / 48.90

Q4-20 49.59 / 49.89

Q1-21 50.76 / 51.06

Q2-21 51.74 / 52.04

CAL21 52.05 / 52.45

ICE Gasoil 10ppm INDIC

Jul20 367.58 / 369.58

Aug20 372.26 / 374.26

Sep20 376.38 / 378.38

Oct20 379.46 / 381.46

Nov20 381.57 / 383.57

Dec20 384.06 / 386.06

Q3-20 372.05 / 374.05

Q4-20 381.70 / 383.70

Q1-21 389.13 / 391.13

Q2-21 397.14 / 399.14

CAL21 399.33 / 401.33

Rott Hi5 Sing Hi5

Jul20 61 74

Aug20 67 77

Sep20 74 81

Oct20 80 85

Nov20 84 87

Dec20 85 89

Q3-20 68 77

Q4-20 83 87

Q1-21 88 93

Q2-21 91 98

CAL21 94 98

UK number: +44 (0)207 090 1134

Shanghai number: +86 (0)21 63012568

|

Luke Longhurst

Ricky Forman

|

Chris Hudson

Jessie Deng |