Good morning all. Brent crude futures fell 31 cents, or 0.8%, to $40.00 per barrel after falling $2.32 on Wednesday. A day earlier, the benchmark contract hit its highest price since early March, just before pandemic lockdowns and a Saudi-Russian price war slammed markets. U.S. WTI crude futures fell 26 cents, or 0.7%, to $37.75 per barrel at 0640 GMT, after dropping $2.36 on Wednesday. The increasing cases of the pandemic in the United States and Latin America has worries that the situation is going to get worse again before it gets better. The world’s biggest lockdown may have eased in India, but the country’s oil refineries are finding it tough going to pull off a complete recovery as fuel demand remains below pre-virus levels and stockpiles swell.

Points from Reuters

MARKETS NEWS:

* Shale Oil Recovery Seen Taking Years After Decade of Excess

* China Gasoline Exports Risk Derailing Motor Fuel’s Recovery

* Aramco Trading Sells Prompt Murban, Agbami Crude From Malaysia

* Gasoline Optimism Hit With Virus Spreading In Sunbelt

* Leaky Pipes, Damaged Wells Threaten Libya’s Oil Revival From War

* Pemex May Crude Oil Output W/Partners 1.63 Mln B/D, -5.1% M/M

* More Idled Shale Capacity Is Coming Back Soon, Dallas Fed Says

* Nigeria Oil, Gas Revenue Fell to $256 Million in March: NNPC

* Petrobras Is Ready to Produce Gasoline Under New Specs

* Oil Supertanker Rates Plunge on Mideast-North Asia Route

OTHER NEWS:

* Carlyle’s Plan to Invest in Oil While Still Saving the Planet

* Oil Taxes and Green Homes Seen Key to Spurring U.K. Recovery

* Exxon, Koch Hid Climate Change Impact for Decades, Suit Says

* Refining NZ to Simplify Operations, May Become Import Terminal

* HSBC Among Banks With Grim Chances to Recoup Hin Leong Loss

PHYSICAL CRUDE NEWS:

* ASIA: Upper Zakum Trades on Window; OPEC+ Laggards in Line

* LATAM: Iranian Captains Sanctioned; Mexican Crude

* US/CANADA: Shale Oil Recovery Seen Taking Years

* NSEA: Totsa Buys Forties Again; Floating Storage Falls

* MED: Surgut Sells Urals to Socar; Freights at YTD Lows

* WAF: Qua Iboe Exports to Drop; Djeno, Doba Exports to Gain

OIL PRODUCT NEWS:

* U.S.: RBOB Contract Drops With Virus Lingering

* EUROPE: Exxon Fawley Flaring; Pembroke FCC Restarts

* ASIA: Reliance-Aramco Deal; Hanwha Naphtha Purchase

ECONOMIC EVENTS: (Times are London.)

* China third batch of May trade data, incl. country breakdowns for energy and commodities

* Singapore onshore oil-product stockpile weekly data

* Insights Global weekly report on European refined product inventories in ARA region

* Russia loading program for July may emerge

ANALYST COLUMNS:

* 2020 Upstream Spending 30% Lower Than Pre-Crash View: WoodMac

* Gasoline, Diesel, Jet Fuel Floating Storage Plunges W/w: Vortexa

* New Refineries May Open East-West Diesel Arbitrage for Good: EA

OTHER FINANCIAL MARKETS:

* Stocks Drop, U.S. Futures Down on Virus Worries: Markets Wrap

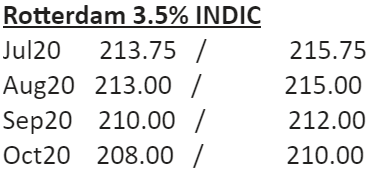

Rotterdam 3.5% INDIC

Jul20 213.75 / 215.75

Aug20 213.00 / 215.00

Sep20 210.00 / 212.00

Oct20 208.00 / 210.00

Nov20 207.50 / 209.50

Dec20 208.75 / 210.75

Q3-20 212.25 / 214.25

Q4-20 208.00 / 210.00

Q1-21 212.25 / 214.25

Q2-21 216.00 / 219.00

CAL21 219.00 / 225.00

Singapore 380 INDIC

Jul20 222.75 / 224.75

Aug20 226.00 / 228.00

Sep20 227.25 / 229.25

Oct20 228.00 / 230.00

Nov20 228.75 / 230.75

Dec20 230.25 / 232.25

Q3-20 225.25 / 227.25

Q4-20 229.00 / 231.00

Q1-21 233.00 / 235.00

Q2-21 236.00 / 239.00

CAL21 238.50 / 244.50

Rott VLSFO 0.5% INDIC

Jul20 270.75 / 276.75

Aug20 275.50 / 281.50

Sep20 279.50 / 285.50

Oct20 283.00 / 289.00

Nov20 286.00 / 292.00

Dec20 288.50 / 294.50

Q3-20 275.25 / 281.25

Q4-20 286.00 / 292.00

Q1-21 294.50 / 300.50

Q2-21 301.00 / 309.00

CAL21 308.00 / 316.00

Singapore VLSFO 0.5% INDIC

Jul20 285.25 / 291.25

Aug20 292.75 / 298.75

Sep20 298.25 / 304.25

Oct20 303.50 / 309.50

Nov20 307.75 / 313.75

Dec20 311.25 / 317.25

Q3-20 292.25 / 298.25

Q4-20 307.50 / 313.50

Q1-21 317.75 / 323.75

Q2-21 324.25 / 332.25

CAL21 331.50 / 339.50

Sing 10ppm GO INDIC

Jul20 45.95 / 46.09

Aug20 45.61 / 45.81

Sep20 45.95 / 46.15

Oct20 46.41 / 46.61

Nov20 46.80 / 47.00

Dec20 47.18 / 47.38

Q3-20 45.75 / 46.05

Q4-20 46.74 / 47.04

Q1-21 48.04 / 48.34

Q2-21 49.25 / 49.55

CAL21 49.57 / 49.97

ICE Gasoil 10ppm INDIC

Jul20 343.33 / 345.33

Aug20 348.27 / 350.27

Sep20 353.00 / 355.00

Oct20 356.66 / 358.66

Nov20 359.37 / 361.37

Dec20 362.37 / 364.37

Q3-20 348.20 / 350.20

Q4-20 359.47 / 361.47

Q1-21 368.45 / 370.45

Q2-21 378.17 / 380.17

CAL21 381.42 / 383.42

Rott Hi5 Sing Hi5

Jul20 59 65

Aug20 65 69

Sep20 72 73

Oct20 77 78

Nov20 81 81

Dec20 82 83

Q3-20 65 69

Q4-20 80 81

Q1-21 84 87

Q2-21 88 91

CAL21 90 94

UK number: +44 (0)207 090 1134

Shanghai number: +86 (0)21 63012568

|

Luke Longhurst

Ricky Forman

|

Chris Hudson

Jessie Deng |