Good morning. Oil is lower today with the virus weighing on demand again. Cases rose in the United States and other places, leading some countries to resume partial lockdowns that could hurt fuel demand. Brent dropped 81 cents, or 2%, to $40.21 a barrel by 0653 GMT, while U.S. was at $37.74, down 75 cents, or 2%.

Brent is set to end June with a third consecutive monthly gain after major global producers extended an unprecedented 9.7 million barrels per day supply cut agreement into July, while oil demand improved after countries across the globe eased lockdown measures. However, global coronavirus cases exceeded 10 million on Sunday as India and Brazil battled outbreaks of over 10,000 cases daily. New outbreaks are reported in countries including China, New Zealand and Australia, prompting governments to impose restrictions again.

“The second wave contagion is alive and well,” Howie Lee, an economist at Singapore’s OCBC bank, said. “That is capping the bullish sentiment that we’ve seen in the last six to eight weeks.” Other factors restricting oil prices’ advance at this stage include poor refining margins, high oil inventories and the resumption of U.S. production, Lee said.

Points from Bloomberg

MARKETS NEWS:

* Chesapeake’s Collapse Is Latest in Long Line of Shale Disasters

* Iraq May Amend High-Cost Oil Output Deals, Jabbar Tells Al-Sabah

* As OPEC+ Cuts Deeper, Norway’s Giant New Field Pumps Flat Out

* Oil Merchants And Tanker Titans Kiss Goodbye to Bonanza Trade

* China’s U.S. Oil Binge Seen Slowing With Virus Revival

* Libya’s Agoco to Resume Oil Output From Eastern Messla Field

* Traders Who Booked Tankers to Store Oil Glut See Demand Plunge

* Shale Fracking Returns, Tapping Huge Glut of Idled Equipment

* OIL ALLOCATIONS: Abu Dhabi Will Cut August Crude Supply by 5%

* ASIA-AMERICAS FUEL: June Flows Set to Be Lowest Since Sept. 2017

PIPELINE/REFINERIES NEWS:

* GENSCAPE REFOUT RECAP: Schwedt, Antwerp, Martinez, Paulsboro

* ENEOS Delays Restart of Kawasaki Refinery CDU to Late July

OTHER NEWS:

* Exxon Prepares to Make Job Cuts Across Oil Giant’s U.S. Offices

* Unlike Last Time, Tanker Market May Take Sanctions In Its Stride

* China’s Buying of U.S. Goods Reaches 19% of 2020 Trade Target

PHYSICAL CRUDE WRAPS:

* ASIA: Hoard Off Singapore Sheds Light on Region’s Recovery

* LATAM: Latam Physical Barrels; Venezuela, India; Guyana

* US/CANADA: Shale Fracking Returns, Taps Equipment Glut

* NSEA: Oseberg Loadings to Rise, Troll Stable; Litasco Bids

* MED: Urals Loadings to Plunge; Surgut, Hellenic Tenders

* WAF: Nigeria’s Exports of 18 Key Grades Gain to 1.72M B/D

OIL PRODUCT WRAPS:

* U.S.: Virus’ 2nd Wave Is Threatening Oil Demand

* Europe: Africa Pulling on Diesel; Pernis VDU

* Asia: Hoard at Sea Sheds Light on Region’s Recovery

ECONOMIC DATA/EVENTS: (Times are London)

* No major events planned

ANALYST VIEWS/COLUMNS:

* Trump’s Inaction Makes Oil Market Management Harder: Julian Lee

OTHER FINANCIAL MARKETS:

* Stocks Mixed as Virus Weighed Against Better Data: Markets Wrap

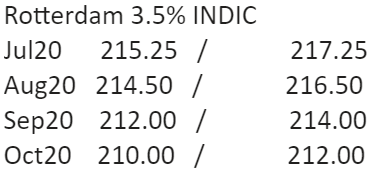

Rotterdam 3.5% INDIC

Jul20 215.25 / 217.25

Aug20 214.50 / 216.50

Sep20 212.00 / 214.00

Oct20 210.00 / 212.00

Nov20 209.75 / 211.75

Dec20 211.00 / 213.00

Q3-20 214.00 / 216.00

Q4-20 210.25 / 212.25

Q1-21 213.75 / 215.75

Q2-21 216.50 / 219.50

CAL21 218.25 / 224.25

Singapore 380 INDIC

Jul20 225.00 / 227.00

Aug20 227.50 / 229.50

Sep20 228.25 / 230.25

Oct20 229.00 / 231.00

Nov20 229.75 / 231.75

Dec20 231.25 / 233.25

Q3-20 227.00 / 229.00

Q4-20 230.00 / 232.00

Q1-21 233.25 / 235.25

Q2-21 235.00 / 238.00

CAL21 238.25 / 244.25

Singapore VLSFO 0.5% INDIC

Jul20 281.25 / 287.25

Aug20 289.00 / 295.00

Sep20 294.75 / 300.75

Oct20 299.75 / 305.75

Nov20 304.25 / 310.25

Dec20 308.00 / 314.00

Q3-20 288.25 / 294.25

Q4-20 304.00 / 310.00

Q1-21 314.25 / 320.25

Q2-21 321.00 / 329.00

CAL21 334.25 / 342.25

Rott VLSFO 0.5% INDIC

Jul20 269.25 / 275.25

Aug20 274.25 / 280.25

Sep20 278.25 / 284.25

Oct20 282.00 / 288.00

Nov20 285.25 / 291.25

Dec20 288.25 / 294.25

Q3-20 273.75 / 279.75

Q4-20 285.00 / 291.00

Q1-21 294.50 / 300.50

Q2-21 301.00 / 309.00

CAL21 309.25 / 317.25

Sing 10ppm GO INDIC

Jul20 45.96 / 46.10

Aug20 45.47 / 45.67

Sep20 45.69 / 45.89

Oct20 46.07 / 46.27

Nov20 46.45 / 46.65

Dec20 46.83 / 47.03

Q3-20 45.65 / 45.95

Q4-20 46.40 / 46.70

Q1-21 47.64 / 47.94

Q2-21 48.88 / 49.18

CAL21 49.48 / 49.88

ICE Gasoil 10ppm INDIC

Jul20 340.63 / 342.63

Aug20 345.34 / 347.34

Sep20 350.17 / 352.17

Oct20 353.99 / 355.99

Nov20 356.66 / 358.66

Dec20 359.62 / 361.62

Q3-20 345.40 / 347.40

Q4-20 356.76 / 358.76

Q1-21 369.07 / 371.07

Q2-21 378.84 / 380.84

CAL21 384.13 / 386.13

Rott Hi5 Sing Hi5

Jul20 56 58

Aug20 62 64

Sep20 68 69

Oct20 74 73

Nov20 78 77

Dec20 79 79

Q3-20 62 63

Q4-20 77 76

Q1-21 83 83

Q2-21 87 89

CAL21 92 97

UK number: +44 (0)207 090 1134

Shanghai number: +86 (0)21 63012568

|

Luke Longhurst

Ricky Forman

|

Chris Hudson

Jessie Deng |