Good morning all. Brent crude fell by 25 cents, or 0.6%, at $42.10 a barrel by 3:41 am GMT. WTI was down 33 cents, or 0.8%, at $39.29. Brent seems to be set for a weekly fall of nearly 2%, while US crude for a drop of more than 3%. Daily COVID-19 infections in US, the world’s bigger oil consumer, stand at a daily record of 60,500, and increasing cases across major economies are leading to the tightening of restrictions to curb the outbreak, with the virus showing no signs of abating, raising concerns about the pace of any recovery. Meanwhile, according to the US Government Energy Information Administration oil inventories rose by nearly 6 million barrels last week after analysts had forecast a decline of just over half that figure. Oil stocks keep being substantial due to the evaporation of demand for gasoline, diesel and other fuels during the initial outbreak. Furthermore, according to Bloomberg data, tankers that have been storing much of the world’s crude while demand plunged are starting to offload cargoes. In the North Sea just a single ship is now left on storage, while according to Vortexa, an analytics firm, in other key locations outside Asia, where delays unloading shipments have complicated the picture, floating inventories have halved to about 35 million barrels since peaking in May. According to Stephen Innes, chief global markets strategist at AxiCorp, concerns about price recovery paired with a national holiday due to elections in key oil hub Singapore will deter traders to place significant bids in the market today, suggesting that prices may continue to wallow into the weekend.

MARKETS NEWS:

* China’s Oil-Buying Habits Give Colombia Advantage Over Brazil

* Nigeria 2021 Budget to Be Based on $35 Oil Price Projection

* Libyan Guards Said to Allow Aframax Oil Tanker Into Es Sider

* Caspian CPC Blend Crude Loadings to Fall to 4.54M Tons in August

* Argentina’s Diesel Demand Recovers to Near Pre-Pandemic Levels

* Cnooc Long Lake Oil Sands May Production Fell Close to Zero

* N.D. Oil Output Seen Near 1M B/D if Dakota Access Shuts: EA

* Pemex Reports Five New Worker Deaths From Covid-19 to Total 191

* Reliance to Load Venezuelan Oil Cargo Under Fuel Swap: Reuters

* India’s June Oil Products Consumption Falls 8% Y/y

OTHER NEWS:

* U.S. Not Deserting Fossil Fuels, DOE Chief Tells Climate Summit

* BP Pays $1 Billion to Reliance for India Fuel Retailing Foray

PHYSICAL CRUDE NEWS:

* ASIA: Chinese Teapots Set to Cut Runs; ONGC Sells Sokol

* LATAM: Colombia vs Brazil in China; Argentina Fuel Demand

* US/CANADA: N.D. Oil Output Seen Near 1M B/D if DAPL Shuts

* NSEA: Unipec, Litasco Offer Ekofisk; Mercuria Bids Forties

* MED: Tanker Allowed to Load From Es Sider; Russia Capacity

* WAF: IOC Buys From Total, Vitol; Chevron Offers Qua Iboe

OIL PRODUCT NEWS:

* U.S.: Phillips 66 Bayway Shut After Power Loss

* EUROPE: Jet Stockpiles Rise in ARA; Diesel Barges

* ASIA: Singapore Stockpiles Swell; China Teapot Runs

ECONOMIC EVENTS: (Times are London.)

* 9:00am: IEA Oil Market Report

* 6:00pm: Baker Hughes U.S. Rig Count

* 6:30pm: ICE Futures Europe weekly Commitments of Traders report

* 8:30pm: CFTC Commitments of Traders report

* Nigerian loading program for September may emerge

* Shanghai exchange’s weekly commodities inventory

** See OIL WEEKLY AGENDA for this week’s events

OTHER FINANCIAL MARKETS:

* Asian Stocks Pare Weekly Advance; Dollar Ticks Up: Markets Wrap

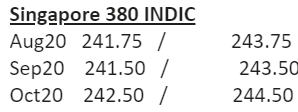

Singapore 380 INDIC

Aug20 241.75 / 243.75

Sep20 241.50 / 243.50

Oct20 242.50 / 244.50

Nov20 243.50 / 245.50

Dec20 244.75 / 246.75

Jan21 246.25 / 248.25

Q4-20 243.75 / 245.75

Q1-21 247.50 / 249.50

Q2-21 249.50 / 251.50

Q3-21 251.25 / 254.25

CAL21 249.25 / 255.25

Rotterdam 3.5% INDIC

Aug20 230.75 / 232.75

Sep20 228.00 / 230.00

Oct20 225.25 / 227.25

Nov20 224.75 / 226.75

Dec20 225.25 / 227.25

Jan21 227.25 / 229.25

Q4-20 225.00 / 227.00

Q1-21 228.50 / 230.50

Q2-21 231.50 / 233.50

Q3-21 233.00 / 236.00

CAL21 230.50 / 236.50

Singapore VLSFO 0.5% INDIC

Aug20 307.50 / 312.50

Sep20 311.00 / 316.00

Oct20 314.50 / 319.50

Nov20 318.50 / 323.50

Dec20 322.25 / 327.25

Jan21 325.75 / 330.75

Q4-20 318.25 / 323.25

Q1-21 328.50 / 333.50

Q2-21 335.00 / 341.00

Q3-21 340.75 / 346.75

CAL21 337.50 / 343.50

Rott VLSFO 0.5% INDIC

Aug20 292.75 / 297.75

Sep20 297.75 / 302.75

Oct20 300.50 / 305.50

Nov20 302.75 / 307.75

Dec20 304.75 / 309.75

Jan21 308.25 / 313.25

Q4-20 302.75 / 307.75

Q1-21 310.50 / 315.50

Q2-21 316.00 / 322.00

Q3-21 321.50 / 327.50

CAL21 318.25 / 324.25

Sing 10ppm GO INDIC

Aug20 48.08 / 48.22

Sep20 47.95 / 48.15

Oct20 48.12 / 48.32

Nov20 48.36 / 48.56

Dec20 48.61 / 48.81

Jan21 49.02 / 49.22

Q4-20 48.30 / 48.60

Q1-21 49.34 / 49.64

Q2-21 50.40 / 50.70

Q3-21 51.47 / 51.77

CAL21 50.77 / 51.17

ICE Gasoil 10ppm INDIC

Aug20 361.94 / 363.94

Sep20 365.38 / 367.38

Oct20 368.05 / 370.05

Nov20 369.69 / 371.69

Dec20 371.90 / 373.90

Jan21 375.12 / 377.12

Q4-20 369.90 / 371.90

Q1-21 376.98 / 378.98

Q2-21 386.66 / 388.66

Q3-21 398.38 / 400.38

CAL21 390.95 / 392.95

Rott Hi5 Sing Hi5

Aug20 63 67

Sep20 71 71

Oct20 77 73

Nov20 79 76

Dec20 81 79

Jan21 82 81

Q4-20 79 76

Q1-21 83 83

Q2-21 86 87

Q3-21 90 91

CAL21 88 88