Oil futures were mixed on Monday morning, with Brent buoyed by tighter supplies to 18 cents (0.4%) at $42.98 a barrel at 2:52 am GMT, while concerns about rising COVID-19 cases in the US dampened WTI futures by 23 cents (0.6%) to $40.42 from its last settlement on Thursday. Newly reported coronavirus cases and mobility data, including an EIA report on gasoline consumption coming out later this week, will be watched by market participants in order to determine the short-term direction of crude prices in the next few days. On the supply side OPEC+ production is at its lowest since 1991 and is helping to support oil market sentiment and fundamentals. However, the current production curbs of 9.7 million b/d is set to expire at the end of July, and ease into cuts of 7.7 million b/d from August until December. As the OPEC+ Joint Ministerial Monitoring Committee meeting is scheduled for July 15, uncertainty persists about the likelihood of the scheduled production increase. According to Stephen Innes, chief global markets analyst at AxiCorp interviewed by Platts, should the forward slope not move into backwardation, OPEC+ will be more inclined to extend the 9.7 million b/d production cut accord beyond July. Meanwhile, Libya is expected to export 1.2 million barrels in July, a third less than the 1.8 million barrels exported in June. In the US the number of operating U.S. oil and natural gas rigs fell to an all-time low for a ninth week, although the reductions have slowed as higher oil prices prompt some producers to start drilling again.

MARKETS NEWS:

* China’s Oil Stockpiles Rise to a Record, Satellite Imaging Shows

* Foreign Forces Enter Libya’s Sedra Oil Port: Local TV

* Tunisia Strike Disrupts Oil Production in South, Official Says

* Yemen Calls for UN Meeting on Aging Oil-Storage Facility

* Sasol Quits Offshore Mozambique Oil, Gas Exploration Licenses

* Asia-Americas Fuel: First July Cargo Booked; June Volumes Slump

* AC Energy Says Power Barge Caused Oil Spill in Iloilo

OTHER NEWS:

* Adnoc Hires Morgan Stanley Veteran Klaus Froehlich as CIO

* As Big Oil Stumbles, Total Manages to Stay on Its Feet

* Kuwait’s Savings for Life After Oil May Be Needed a Lot Sooner

* Africa’s Biggest Investment Takes Shape Amid Islamist Threat

* Hyundai Motor Ships Hydrogen Fuel-Celled Trucks to Switzerland

PHYSICAL CRUDE NEWS:

* ASIA: Some Cargoes Floating Off China Re-Offered or Sold

* LATAM: Brazil Oil Exports Fall; Mexico Fuel Demand Rises

* US/CANADA: Oil-Rig Slump Deepens in U.S., Least Since 2009

* NSEA: Mercuria Seeks to Buy Forties; Litasco Bids

* MED: Glencore Sells Urals; Azeri, CPC Flows to Asia Fell

* WAF: Sonangol Sells to Unipec; Angola Pressured Over Cuts

OIL PRODUCT NEWS:

* EUROPE: Flow to Americas Jumps; Fawley FCC Restarts

* ASIA: Distillates Stored at Sea Up; Lotte Titan Buy

* U.S.: Trainer Refinery Dips Back Into Jet Market

ECONOMIC EVENTS: (Times are London.)

* 8:30pm CFTC Commitments of Traders report, delayed release

from Friday due to U.S. federal holiday

* IEA Releases Monthly Report; EIA Outlook

ANALYST COLUMNS:

* Chinese Clean Fuel Exports Halve in June From March: Kpler

* Climate Change Poses Big Risk for Oil Infrastructure: Julian Lee

OTHER FINANCIAL MARKETS:

* Stocks Start Week With Gains; Treasuries Slip: Markets Wrap

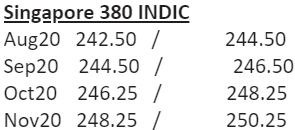

Singapore 380 INDIC

Aug20 242.50 / 244.50

Sep20 244.50 / 246.50

Oct20 246.25 / 248.25

Nov20 248.25 / 250.25

Dec20 250.25 / 252.25

Jan21 252.00 / 254.00

Q4-20 248.25 / 250.25

Q1-21 253.25 / 255.25

Q2-21 255.50 / 257.50

Q3-21 257.00 / 260.00

CAL21 253.75 / 259.75

Rotterdam 3.5% INDIC

Aug20 233.25 / 235.25

Sep20 231.50 / 233.50

Oct20 229.75 / 231.75

Nov20 229.75 / 231.75

Dec20 231.00 / 233.00

Jan21 232.75 / 234.75

Q4-20 230.25 / 232.25

Q1-21 234.00 / 236.00

Q2-21 236.75 / 238.75

Q3-21 238.25 / 241.25

CAL21 235.25 / 241.25

Singapore VLSFO 0.5% INDIC

Aug20 320.25 / 325.25

Sep20 324.25 / 329.25

Oct20 328.25 / 333.25

Nov20 332.00 / 337.00

Dec20 335.75 / 340.75

Jan21 339.25 / 344.25

Q4-20 332.00 / 337.00

Q1-21 341.75 / 346.75

Q2-21 348.75 / 354.75

Q3-21 355.50 / 361.50

CAL21 351.50 / 357.50

Rott VLSFO 0.5% INDIC

Aug20 305.50 / 310.50

Sep20 308.75 / 313.75

Oct20 311.25 / 316.25

Nov20 313.50 / 318.50

Dec20 315.75 / 320.75

Jan21 318.00 / 323.00

Q4-20 313.50 / 318.50

Q1-21 320.25 / 325.25

Q2-21 326.00 / 332.00

Q3-21 331.00 / 337.00

CAL21 328.00 / 334.00

Sing 10ppm GO INDIC

Aug20 49.42 / 49.56

Sep20 49.31 / 49.51

Oct20 49.49 / 49.69

Nov20 49.70 / 49.90

Dec20 49.96 / 50.16

Jan21 50.30 / 50.50

Q4-20 49.70 / 49.90

Q1-21 50.66 / 50.86

Q2-21 51.66 / 51.86

Q3-21 52.68 / 52.88

CAL21 51.94 / 52.34

ICE Gasoil 10ppm INDIC

Aug20 372.28 / 374.28

Sep20 375.64 / 377.64

Oct20 377.79 / 379.79

Nov20 379.27 / 381.27

Dec20 381.71 / 383.71

Jan21 384.48 / 386.48

Q4-20 379.60 / 381.60

Q1-21 386.50 / 388.50

Q2-21 393.74 / 395.74

Q3-21 397.10 / 399.10

CAL21 394.99 / 396.99