Good morning all. Brent futures rose 2 cents, or 0.05%, to $43.31, by 4:43 am GMT, while WTI futures dipped 3 cents, or 0.07%, to $40.87 a barrel. According to data from the US Energy Information Administration, US oil stockpiles for the week ended July 3 increased by 5.7 million barrels from the previous week to 539.2 million barrels, nearly 18% above the five-year average. On the other hand, gasoline inventories fell by 4.8 million barrels last week as demand climbed to 8.8 million barrels per day, the highest since March 20. Jet fuel demand rose by 336,000 b/d to 924,000 b/d, a 14-week high but still 56% below the previous year. Data from data analytics company Kayrros shows that driving demand rose in every US state in the previous week, except for Arizona, Texas and Florida, which of late have seen a sharp spike in COVID-19 cases. Despite the United States reporting more than 60,000 new COVID-19 cases on Wednesday, the biggest increase ever reported by a country in a single day, Raphael Bostic, the President of the Atlanta Fed, reassured the public that broad shutdown aren’t to be expected. Total products supplied, often used as a proxy for demand, was up 766,000 b/d to 18.1 million b/d for the week ended July 3, just 15.1% below year-on-year consumption. Furthermore, the market is hesitant ahead of the July 15 OPEC+ market monitoring panel meeting. As traditional overproducers are pushed to comply with the cuts, the group could decide to cut or extend their record 9.7 million bpd supply cut from August. On another note, Libya’s National Oil Corp tried to lift force majeure at the Es Sider oil terminal on Wednesday, however an oil tanker was prevented from entering the port.

MARKETS NEWS:

* Chinese Refiners Post-Lockdown Boom Crushed by Oil Above $40

* Libya Port Guards Block Tanker From Loading Oil, Defying Tripoli

* Mexico Gives Talos, Pemex 120 Days to Merge Giant Oil Discovery

* China Teapots Get 26.84M Tons of Crude Import Quota in 3rd Batch

* U.S. Crude Inventories Rise, Gasoline Demand Gains: EIA Takeways

* BTC Azeri Crude Loadings to Rise to 16.5M Bbl in August: Plan

* Savant Alaska Receives Permission to Shut Badami Oil Wells

* Libya’s Messla Oilfield Halts Production After Refinery Trips

* Egypt to Keep 3Q Domestic Fuel Prices Unchanged: Oil Ministry

* Nigeria’s NNPC Reports Explosion on Onshore Oil Platform

OTHER NEWS:

* Private Equity in Shale Patch Taps Millions in U.S. Virus Aid

* Restructuring Proposed for Hin Leong’s Ocean Tankers: ST

* Pregnant and Stuck on a Ship in the Middle of the Pandemic

PHYSICAL CRUDE NEWS:

* ASIA: Adnoc Raises Murban OSP; Qatar Offers September LSC

* LATAM: Colombia Fuel Demand; U.S. Imports From Mexico

* US/CANADA: U.S. Gasoline Demand at Pre-Pandemic Levels

* NSEA: Mercuria Buys Ekofisk; Glencore Offers Oseberg

* MED: Shell Bids Urals Lower; BTC Loadings to Rise in Aug.

* WAF: Explosion at Onshore Platform in Nigeria; Djeno Sales

OIL PRODUCT NEWS:

* U.S.: Gasoline Makers Can’t Go Easy Quite Yet

* EUROPE: OMV Hedges; Diesel Barges; Sarroch Gasoline

* ASIA: Floating Diesel Stockpiles Drop; Formosa Runs

ECONOMIC EVENTS:

* Singapore onshore oil-product stockpile weekly data

* Insights Global weekly report on European refined product

inventories in ARA region

ANALYST COLUMNS:

* U.S. Gasoline Demand to Return to 2019 Level in Aug.: Genscape

OTHER FINANCIAL MARKETS:

* Asian Stocks Push Higher Led by Gains in China: Markets Wrap

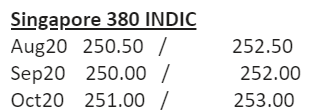

Singapore 380 INDIC

Aug20 250.50 / 252.50

Sep20 250.00 / 252.00

Oct20 251.00 / 253.00

Nov20 252.00 / 254.00

Dec20 253.25 / 255.25

Jan21 254.50 / 256.50

Q4-20 252.25 / 254.25

Q1-21 255.25 / 257.25

Q2-21 257.25 / 259.25

Q3-21 259.00 / 262.00

CAL21 256.00 / 262.00

Rotterdam 3.5% INDIC

Aug20 238.25 / 240.25

Sep20 235.50 / 237.50

Oct20 233.00 / 235.00

Nov20 232.50 / 234.50

Dec20 233.00 / 235.00

Jan21 235.00 / 237.00

Q4-20 233.00 / 235.00

Q1-21 236.00 / 238.00

Q2-21 238.50 / 240.50

Q3-21 240.00 / 243.00

CAL21 237.50 / 243.50

Singapore VLSFO 0.5% INDIC

Aug20 315.50 / 320.50

Sep20 319.25 / 324.25

Oct20 323.00 / 328.00

Nov20 327.00 / 332.00

Dec20 330.25 / 335.25

Jan21 333.25 / 338.25

Q4-20 326.75 / 331.75

Q1-21 335.75 / 340.75

Q2-21 342.25 / 348.25

Q3-21 348.25 / 354.25

CAL21 344.75 / 350.75

Rott VLSFO 0.5% INDIC

Aug20 301.50 / 306.50

Sep20 306.25 / 311.25

Oct20 309.50 / 314.50

Nov20 312.00 / 317.00

Dec20 314.25 / 319.25

Jan21 317.50 / 322.50

Q4-20 311.75 / 316.75

Q1-21 319.75 / 324.75

Q2-21 325.50 / 331.50

Q3-21 330.75 / 336.75

CAL21 327.75 / 333.75

Sing 10ppm GO INDIC

Aug20 49.04 / 49.18

Sep20 48.99 / 49.19

Oct20 49.19 / 49.39

Nov20 49.46 / 49.66

Dec20 49.76 / 49.96

Jan21 50.14 / 50.34

Q4-20 49.45 / 49.65

Q1-21 50.51 / 50.71

Q2-21 51.55 / 51.75

Q3-21 52.53 / 52.73

CAL21 51.83 / 52.23

ICE Gasoil 10ppm INDIC

Aug20 370.38 / 372.38

Sep20 374.24 / 376.24

Oct20 376.92 / 378.92

Nov20 378.60 / 380.60

Dec20 381.09 / 383.09

Jan21 384.01 / 386.01

Q4-20 378.85 / 380.85

Q1-21 386.11 / 388.11

Q2-21 394.57 / 396.57

Q3-21 402.90 / 404.90

CAL21 397.85 / 399.85

Rott Hi5 Sing Hi5

Aug20 67 68

Sep20 74 72

Oct20 80 75

Nov20 83 78

Dec20 84 80

Jan21 86 82

Q4-20 82 78

Q1-21 87 84

Q2-21 93 89

Q3-21 97 92

CAL21 90 92