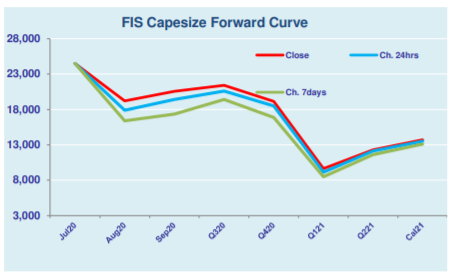

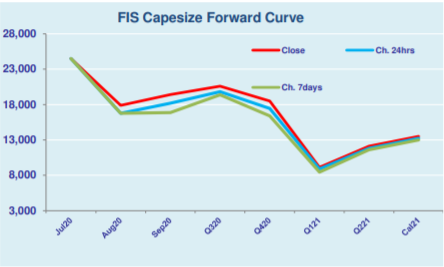

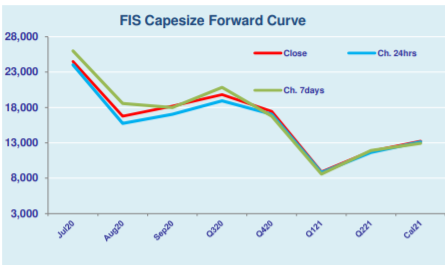

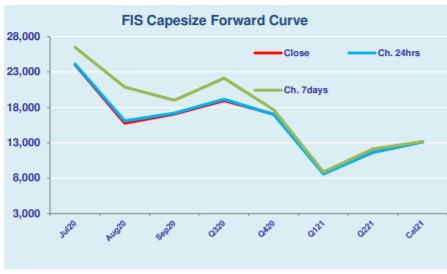

Capesize rates jumped on better physical market with both basins seemed significant gains despite an upcoming public holiday in Singapore. The Capesize 5 time charter average hiked up by $1,197 day-on-day to $17,721 on Wednesday, with Aug and Sep contracts traded on highs of $19,250 and $20,750 respectively. With improvement in Capesize, the Baltic Dry …

Continue reading “Capesize rates rebound on firm Pacific market”