Tag archives: CS

Capesize rate slides toward $20,000 level on supply glut

Capesize rates continued its downward slide toward the $20,000 level due to the supply glut in the market. The Capesize 5 time charter average fell by $2,515 day-on-day to $20,120 on Wednesday, as trading came to stalemate and slowed in final two hours before the afternoon closing. The Baltic Dry Index (BDI) then slipped by …

Continue reading “Capesize rate slides toward $20,000 level on supply glut”

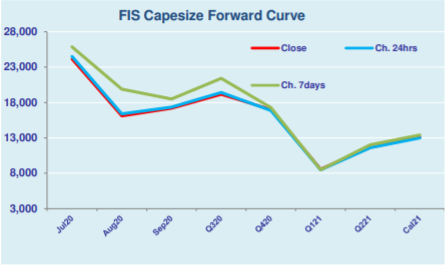

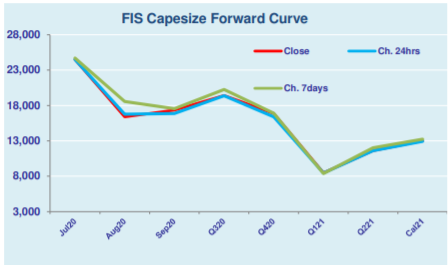

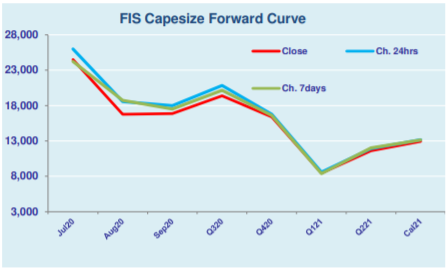

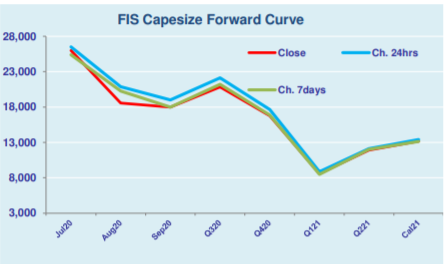

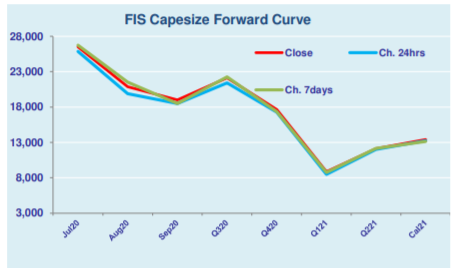

Capesize & Panamax FFA Daily Report

FIS Singapore Iron Ore Derivatives Report 22/07/2020

Iron ore futures slumped on Wednesday morning in London on fresh concerns over rising US-China tensions after US forced the closure of the Chinese Consulate at Houston. Iron ore futures initially held firm, with Aug hovering around mid-108 despite China’s Ministry of Industry and Information Technology warned on Tuesday that current iron ore prices …

Continue reading “FIS Singapore Iron Ore Derivatives Report 22/07/2020”

Capesize rates drag down by high tonnage list

Capesize rates spiraled downward due to high tonnage list that resulted weakness in the Pacific market. As such, the Capesize 5 time charter average dropped further by $1,834 day-on-day to $22,635 on Tuesday, after a steep sell off down the curve during late afternoon session. Following the decline, the Baltic Dry Index (BDI) slipped by …

Continue reading “Capesize rates drag down by high tonnage list”

Capesize & Panamax FFA Daily Report

Capesize rates dip on subdued markets

Capesize rates reversed into losses after sluggish start to the week with little shipping activities. Thus, the Capesize 5 time charter average dropped by $616 day-on-day to $24,469 on Monday, due to the subdued Pacific and Atlantic market. The Baltic Dry Index (BDI) then followed the dip and slipped by 1.87% day-on-day to 1,678 readings …

Capesize & Panamax FFA Daily Report

Capesize & Panamax FFA Daily Report

Capesize rebounds upon market optimism

Capesize rates ended its losing streaks and booked slight gains with improvement of shipping demands in both basins. The Capesize 5 time charter average went up $252 day-on-day to $24,639 on Thursday, as the Australian miners returned to the spot market. Given the Capesize uptick, the Baltic Dry Index (BDI) inched up slightly by 0.18% …