Tag archives: CS

Capesize rates venture into a week of correction

Capesize rates came under correction again, perhaps fulfilling market expectation of a week for correction due to shipping supply glut. The Capesize 5 time charter average then fell further by $1,175 day-on-day to $24,387 by mid-July, 15 July 2020, despite an influx buyers entered at the afternoon session. Following the decline, the Baltic Dry Index …

Continue reading “Capesize rates venture into a week of correction”

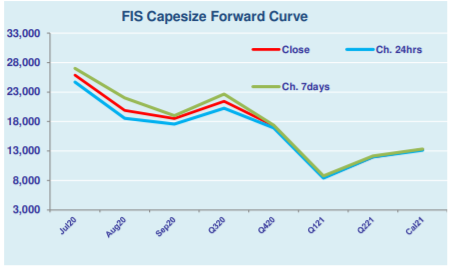

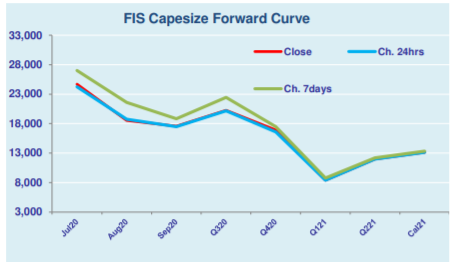

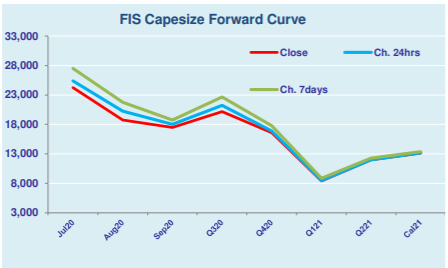

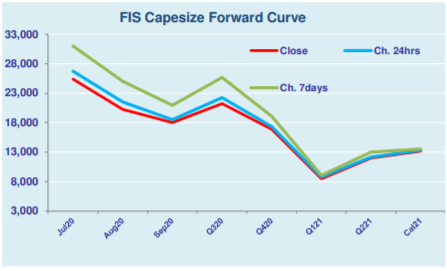

Capesize & Panamax FFA Daily Report

Capesize rates spiral down from supply buildups

Capesize rates continued its downward slide as supply buildups, while shipping demand remained yet to be seen in the market. Following the decline, the Capesize 5 time charter average dived down by $1,402 day-on-day to $25,562 on Tuesday. Likewise, the Baltic Dry Index (BDI) continued to descend and dropped by 2.79% day-on-day at 1,742 readings. …

Continue reading “Capesize rates spiral down from supply buildups”

Capesize & Panamax FFA Daily Report

FIS Capesize Technical Report

FIS Weekly Ferrous: iron ore neutral but risk remains

Ferrous Sector Money-flow: The previous weekly report gave seven weeks of short-run consolidation from the end of May when seeing the open interest peak for DCE market. However market was strong by the first half of July. Open interest indicated most of the push was due to exit of shorts and re-entry as new …

Continue reading “FIS Weekly Ferrous: iron ore neutral but risk remains”

Capesize rates slip on thin physical activity

Capesize rates slipped again over market concerns on the deteriorating physical market with long tonnage list in the Pacific market. On that note, the Capesize 5 time charter average dipped by $680 day-on-day to $26,964 on Monday, as the paper market came under pressure on declining physical market. Following the decline, the Baltic Dry Index …

Continue reading “Capesize rates slip on thin physical activity”

Capesize & Panamax FFA Daily Report

Capesize rates correct on muted market activity

Capesize rates dropped on limited market activity as some trade participants were away due to public holiday in Singapore. The Capesize 5 time charter average dipped by $437 day-on-day to $27,644 on Friday, as the paper market was muted and rangebound due to the Singapore holiday. Due to the quiet market, the Baltic Dry Index …

Continue reading “Capesize rates correct on muted market activity”