Tag archives: CS

Capesize maintains over $30,000 level despite softening demand

Capesize rates hovered above the $30,000 level, despite softening freight rates recorded in both Pacific and Atlantic markets. This weakness was reflected in the paper market, which the Capesize 5 time charter average saw a slight gain of $62 day-on-day to $30, 939 on Wednesday, from a weak afternoon session. The Baltic Dry Index (BDI) …

Continue reading “Capesize maintains over $30,000 level despite softening demand”

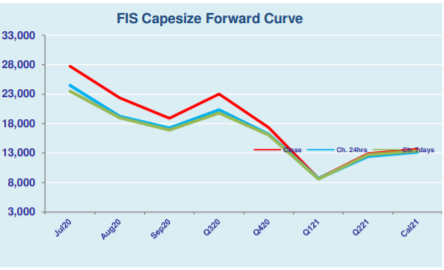

Capesize & Panamax FFA Daily Report

FIS Capesize Technical Report

Capesize – Seven Years of Famine

Arguably the largest % gain ever during a 32-day period for the Capesize index having moved 1,449% higher (USD 28,865), the index is now within USD 7,000 of the 2019 high. Above this level will be unchartered territory for the 5TC Capesize index which replaced the old index back in 2014. We have seen moves …

Capesize hovers above $30,000 level and BDI reaches year-high

Capesize rates stabilized at the $30,000 level, but the market remained at backwardation as some trade participants do not believe on the long-term strength of capes. Thus, the Capesize 5 time charter average saw a small gain of $79 day-on-day to $30, 857 on Tuesday. The Baltic Dry Index (BDI) also spotted small gain of …

Continue reading “Capesize hovers above $30,000 level and BDI reaches year-high”

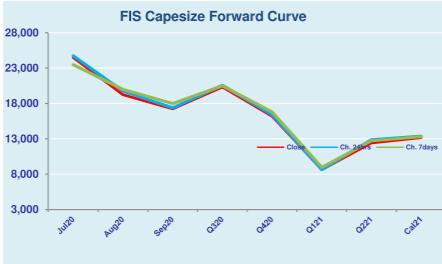

Capesize & Panamax FFA Daily Report

Capesize breaks the $30,000 level on robust shipping demand

It was another a bullish day for Capesize rates as the $30,000 level was broken due to firm shipping demand in moving iron ore cargoes. With the return of Chinese trade participants from holidays, the Capesize 5 time charter average surged by $1,137 day-on-day to $30,778 on Monday. The Baltic Dry Index (BDI) then peaked …

Continue reading “Capesize breaks the $30,000 level on robust shipping demand”

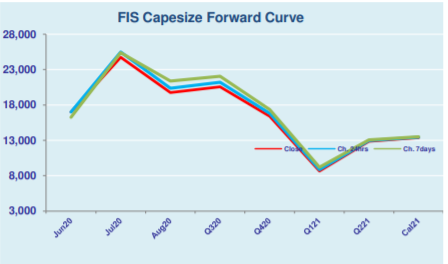

Capesize & Panamax FFA Daily Report

Capesize gains despite China’s holidays

Capesize rates saw little gains as Chinese trade participants were away on holidays, leaving the market with thin activities. Despite the muted activities, the Capesize 5 time charter average still managed to rise by $246 day-on-day to $29,641 on Friday. The Baltic Dry Index (BDI) kept its upward momentum to 1,749 points on Jun 26, …