Tag archives: CS

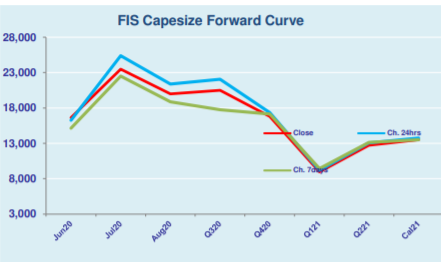

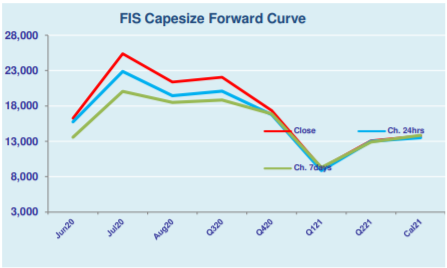

Capesize rates slow down amid Chinese holidays

Capesize rates moved slower but gradually toward the $30,000 mark, due to the absence of Chinese trade participants during the Dragon Boat Festival holidays. Therefore, the Capesize 5 time charter average rose by $738 day-on-day to $29,395 on Thursday, despite some market concerns about the longevity of the C3 contracts. Strengthened by Capesize market, the …

Continue reading “Capesize rates slow down amid Chinese holidays”

Capesize July 20 Morning Technical Comment – 240 Min

Did Someone Mention Increasing Demand?

It is the panacea for all markets, the biggest factor that could help us recover some sense of normality, the only thing that will bring a smile to suppliers across the world. It is, of course, increasing demand. The virus has caused huge disruption and left markets unable to react quickly enough to counteract …

Capesize & Panamax FFA Daily Report

Capesize sets sight on $30,000 level

Capesize rates seemed to set its sight for the $30,000 level in view of high iron ore prices that lifted shipping demand for moving iron ores. The Capesize 5 time charter average hiked up further by $1,985 day-on-day to $28,657 on Wednesday, despite aggressive sell off at the Q3 contracts. Due to Capesize rally, the …

Capesize & Panamax FFA Daily Report

Freight—The Reality of the Ratio

Capesize rallies on high iron ore prices

Capesize rates rallied on bullish market sentiments after strong gains seen in both the Pacific and Atlantic basins. The Capesize 5 time charter average surged by $1,308 day-on-day to $26,672 on Tuesday, despite the lagging Q4 and Cal 21 contracts in the future market. Buoyed by the Capesize rally, the Baltic Dry Index (BDI) continued …