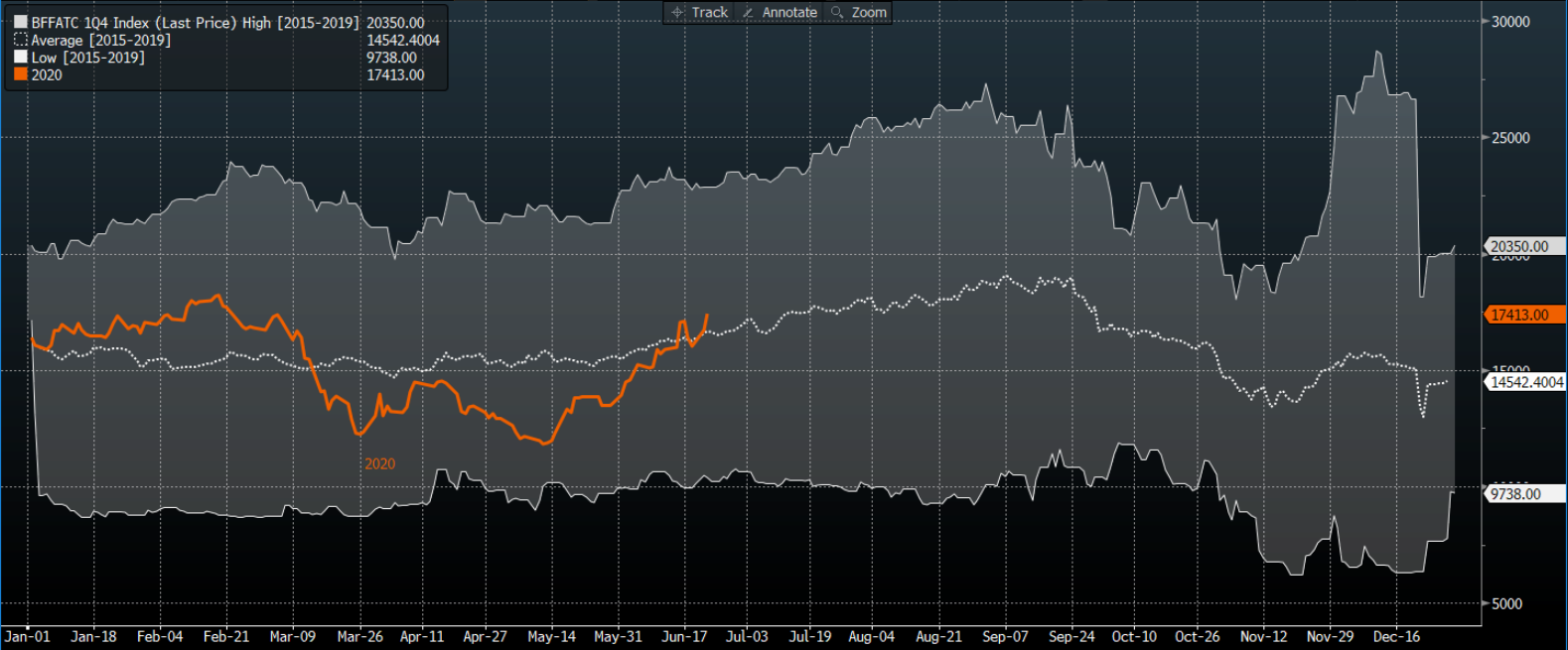

Another strong day in the dry freight market with the Capesize index up 5.16% due to Chinese iron ore restocking and increased infrastructure spending. The index out outperformed the Baltic Dry Index which rose 3.79% after positive performances from the Panamax index at + 1.65% and Supramax Index + 0.77%. The continued upside moves …

Tag archives: CS

Capesize goes on a bumpy ride

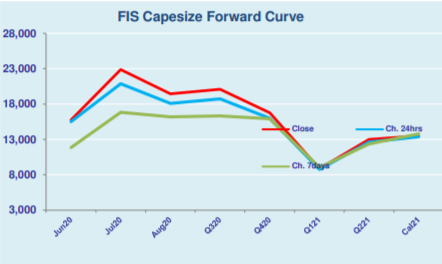

After a strong rally last week, Capesize rates started on a slow with some selling pressure amid the short trading week. Thus, Capesize 5 time charter average dropped slightly by $147 day-on-day to $25,364 on Monday, after some jitters in the morning session about the strength of C3 market. Due to the selling pressure in …

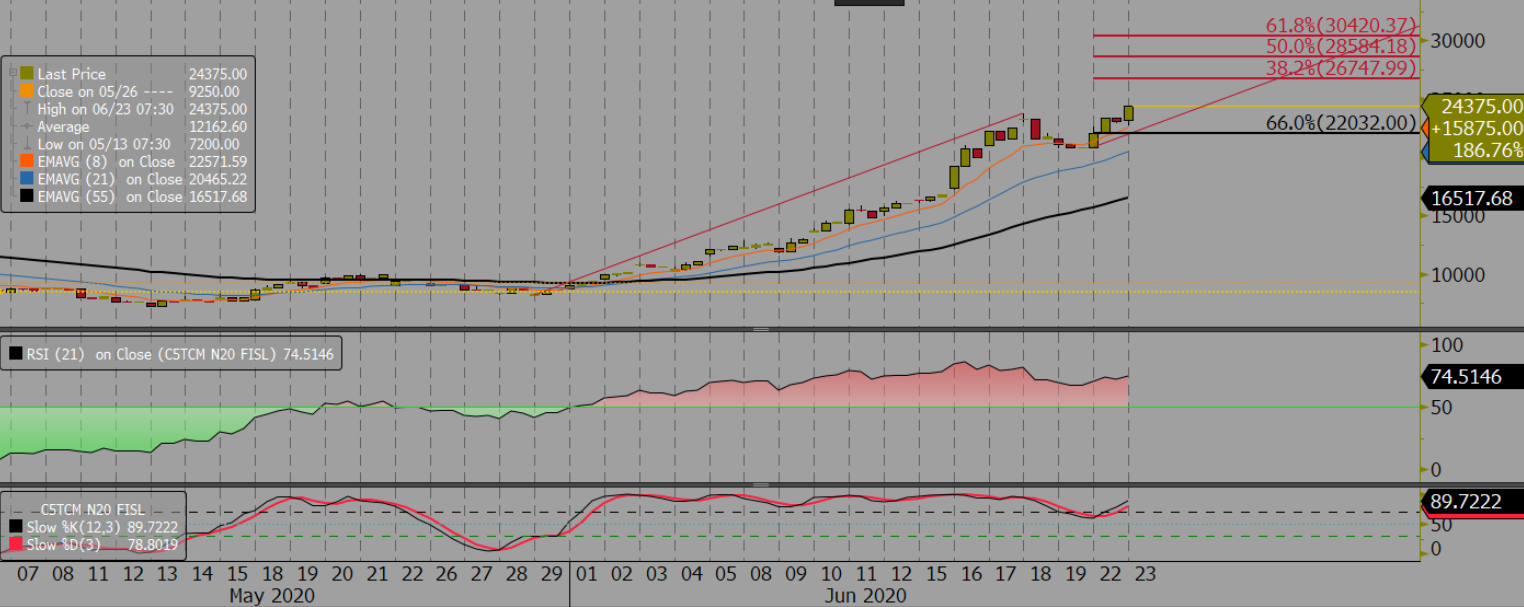

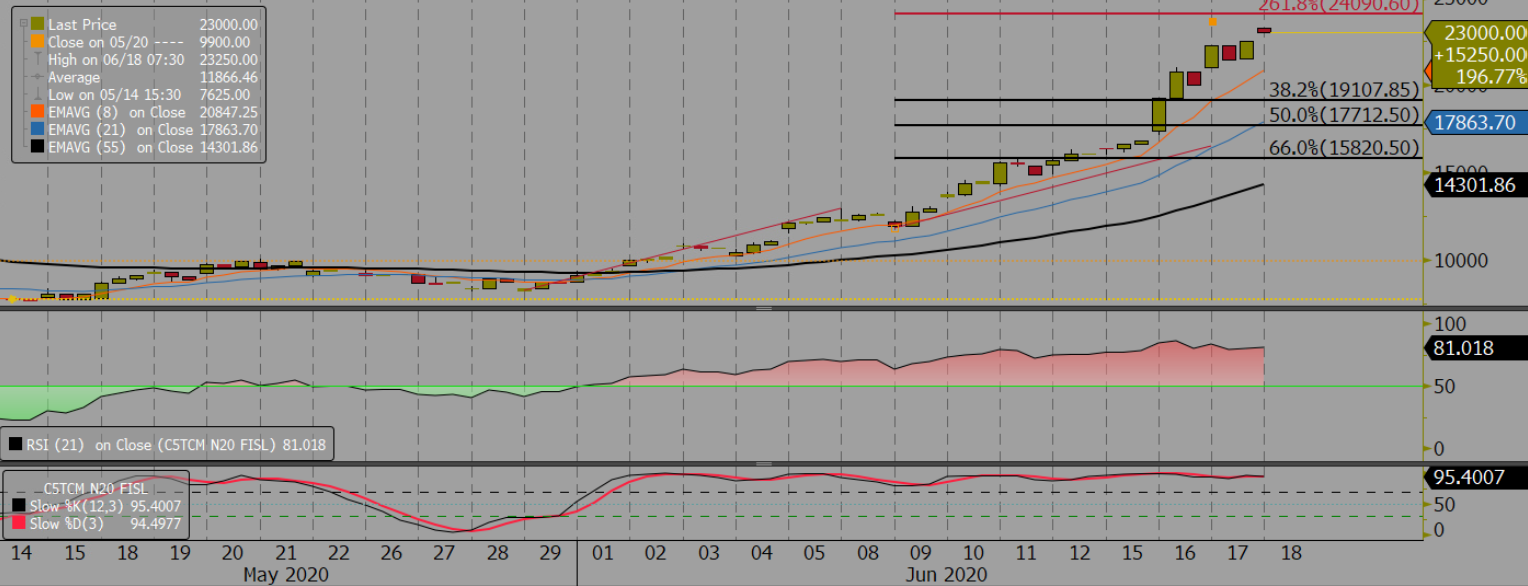

Capesize July 20 Morning Technical Comment – 240 Min

Capesize & Panamax FFA Daily Report

Capesize hits a new norm at $25,000 level

Capesize rates had a meteoric rise for the week, jumping from $13,000 base level to over $25,000 level by the end of week on good shipping demand. The Capesize 5 time charter average made a gain of $231 day-on-day to $25,511 on Friday, spotting one of the smallest gains of the week as compared to …

Continue reading “Capesize hits a new norm at $25,000 level”

Capesize & Panamax FFA Daily Report

Capesize breaks the $20,000 level

Capesize rates reached another new height again and broke the $20,000 level amid the freight rally. Thus, the Capesize 5 time charter average increased by $6,244 day-on-day to $25,280 on Thursday, another year-high rates, even after a selloff by trade participants for profit-taking. Supported by robust Capesize market, the Baltic Dry Index (BDI) achieved the …

ShipShape: The Long and Winding Road

It is one of the best-known Beatles songs from their final studio album Let It Be, but it also encapsulates perfectly the challenge many commodity markets face as they begin to recover from the enormous disruption of Coronavirus. The pandemic has impacted every metric you can think of: quantitative easing, government debt, unemployment, share …

Capesize rates chase for new height

Capesize rates continued to chase new height for the year, buoyed by the strong shipping and iron ore demand. The Capesize 5 time charter average rose by $4,250 day-on-day to $19,036 on Wednesday, another year-high as the paper market saw over 8,000 lots change hands by the close of trading day. Likewise, the Baltic Dry …