Tag archives: CS

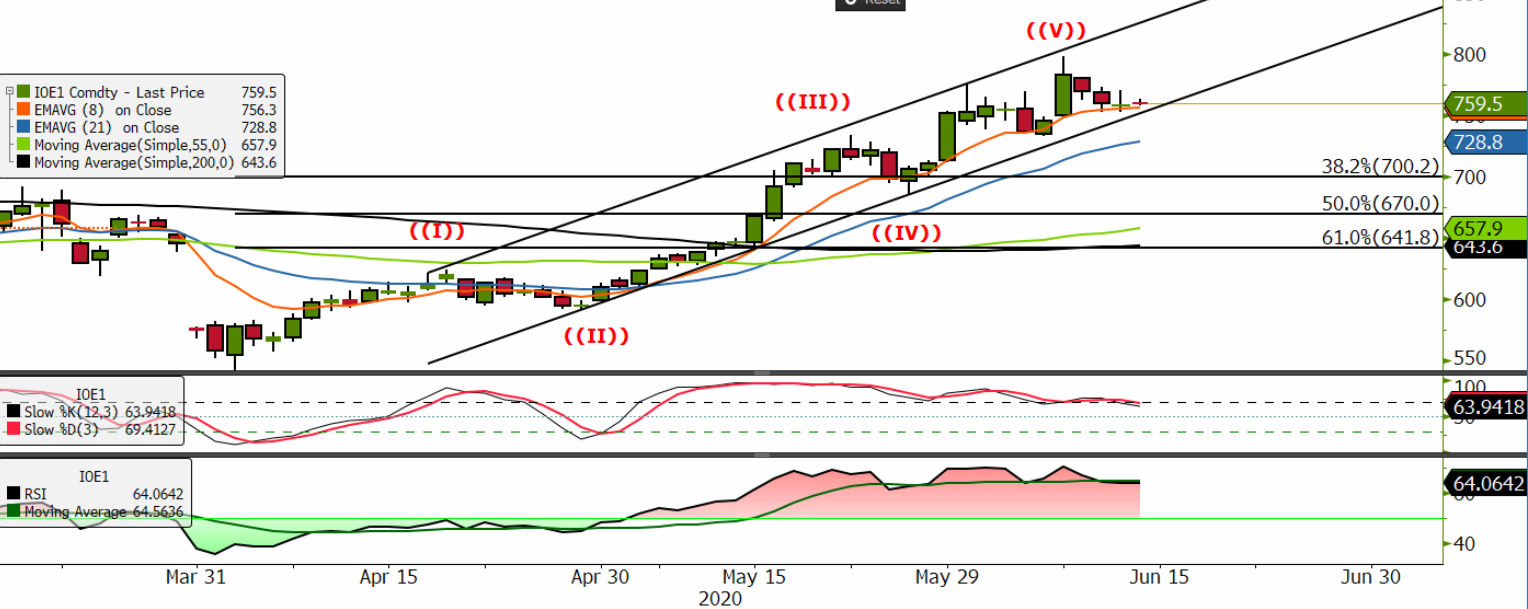

FIS Technical – DCE Iron Ore Sep 20

FIS Technical – DCE Iron Ore Sep 20 To view the full report please click on the link

Capesize rates race ahead on robust shipping demand

Capesize rates continued to race upward with better shipping demand in both basins, supported by the recent iron ore rally. The Capesize 5 time charter average surged up by another $1,087 day-on-day to $9,142 on Wednesday, marking a rise throughout the week. Likewise, the Baltic Dry Index (BDI) continued to hike and reached 764 points …

Continue reading “Capesize rates race ahead on robust shipping demand”

Capesize July 20 Morning Technical Comment – 240 Min

Iron ore softer as pundits exchange views on supply outlook

Iron ore futures were a touch softer on Wednesday as investors assessed the supply outlook for iron ore following the recent closure of Vale’s Itabria complex. Investors grew concerned over tight supply after Vale was ordered to shut down Itabria, which accounts for over 10% of Vale’s output, in the state of Minas Gerais …

Continue reading “Iron ore softer as pundits exchange views on supply outlook”

Capesize pushes ahead with iron ore rally

Capesize rates continued to push forward with firm iron ore demand that pushed for more shipping activities in the Pacific market. Thus, the Capesize 5 time charter average hiked up by another $310 day-on-day to $8,055 on Tuesday, for the second consecutive day-rise for the week. Following the rally, the Baltic Dry Index (BDI) broke …

Continue reading “Capesize pushes ahead with iron ore rally”

Capesize rides along with the iron ore bull run

Capesize rates continued the bullish run over Brazilian supply concerns, while high construction activities in China support iron ore demand. As such, the Capesize 5 time charter average jumped by $438 day-on-day to $7,745 on Monday, after more European players entered the market and pushed up rates. The Baltic Dry Index (BDI) followed the rally …

Continue reading “Capesize rides along with the iron ore bull run”

Capesize July 20 Morning Technical Comment – 240 Min

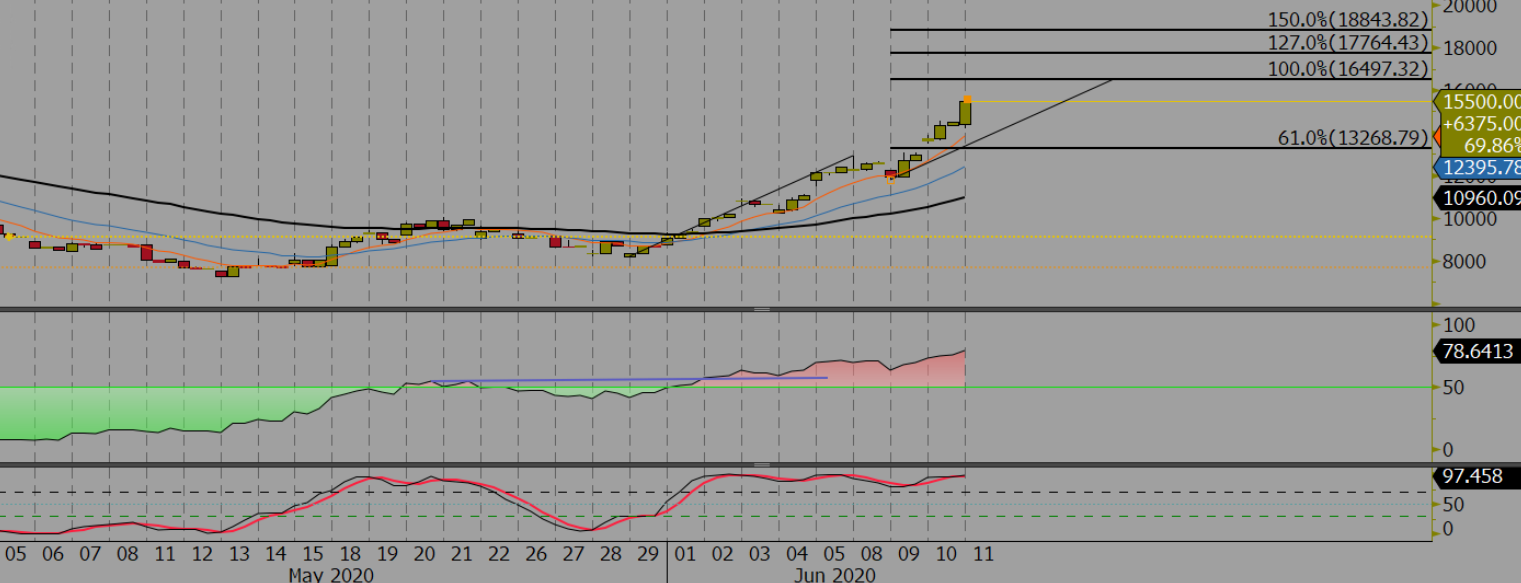

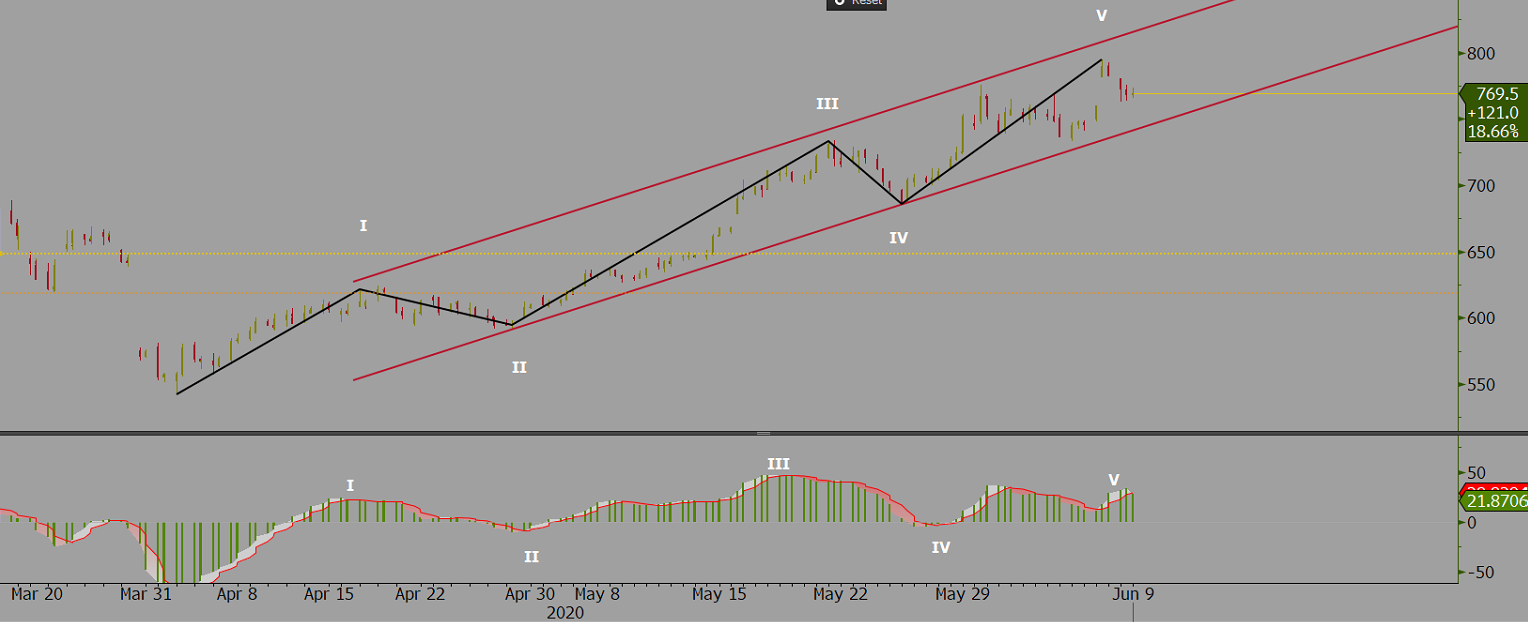

Has Iron Ore Reached its Top?

Consensus The consensus in the financial sector is that iron ore prices are looking overstretched. Almost daily we hear that supply will increase and demand will decrease in the second half of the year. If this is the case, then surely with over 100 million tons of inventory the upside is not limited, it is …