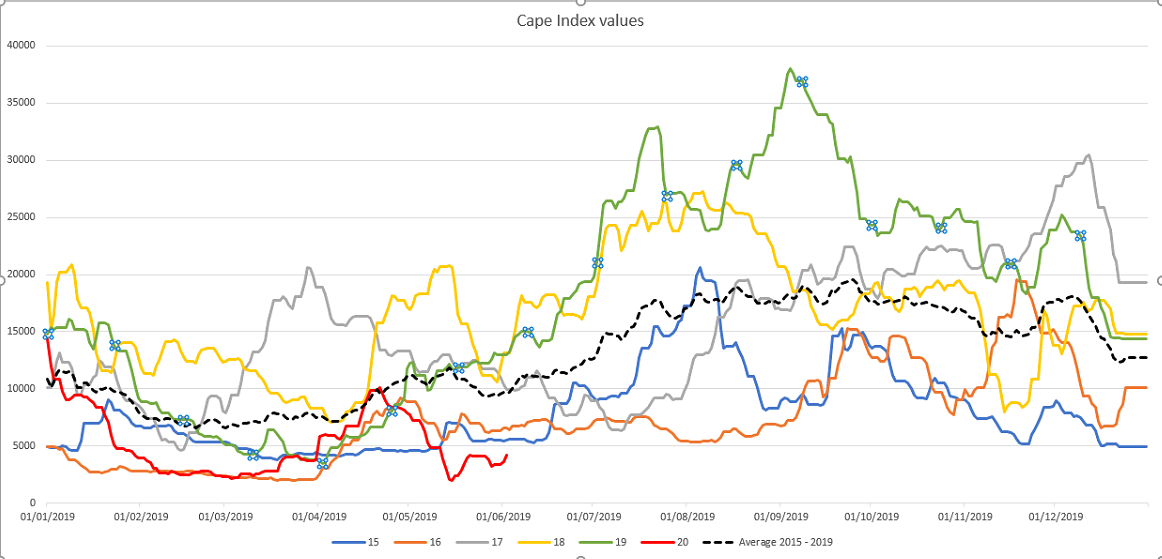

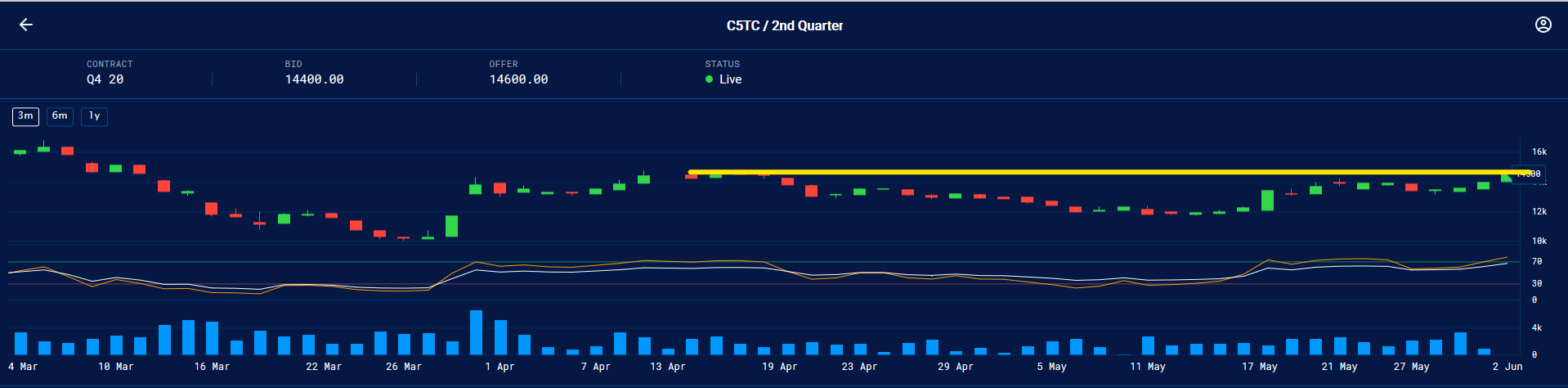

Capesize rates buoyed on good physical fixture with healthy shipping demand out of both basins. Thus, the Capesize 5 time charter average spiked sharply by $1,130 day-on-day to $7,307 on Friday, after a solid gain that lifted the curve to weeks highs. Following the Capesize rally, the Baltic Dry Index (BDI) also surged further to …

Continue reading “Capesize rates continue the good run on firmer iron ore demand”