Iron ore futures advanced on Wednesday as investors gauged over short-term iron ore supply. On one hand, Australian miners have been going flat out and the country may be shipping in record volumes. According to initial tally compiled by Bloomberg, shipments from Australia were up by 3.2 million tonnes in May year-on-year to 79.7 …

Tag archives: CS

Capesize firms on better fundamentals

Capesize rates firmed up with improvements seen in both the Pacific and Atlantic basins on better shipping demand. Higher bunker prices also lent support to the rising freight rates that pushed the Baltic Dry Index (BDI) higher to 546 points, up 5% day-on-day on Tuesday. Good fundamentals in Pacific market The Pacific …

Capesize July 20 Morning Technical Comment – 240 Min

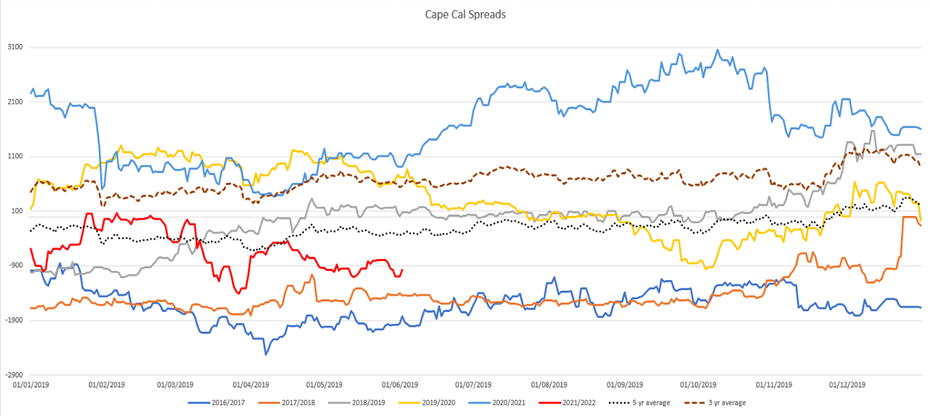

Cape Cal 21 v 22 Spread

Cape Cal 21 v 22 Spread To view the full report please click on the

Iron ore “could continue to test new highs”

Iron ore futures rallied above $98 on Tuesday on better Chinese outlook and ongoing supply concerns from Brazil. Iron ore port inventories have fallen to a four-year low as China moved past the coronavirus pandemic, prompting Chinese steel mills to ramp up output, boosting demand for iron ore. The latest Purchasing Manager’s Index for …

Continue reading “Iron ore “could continue to test new highs””

Capesize rates hike up amid European holidays

Capesize rates gained slightly despite holidays across Europe that took off several players out of the market. Despite of thin trading, the Capesize 5 time charter average hiked by $279 to $3,648 on Monday, without any noticeable change in the physical market. In the meantime, the Baltic Dry Index (BDI) had gained steadily to 520 …

Continue reading “Capesize rates hike up amid European holidays”

Vale expected to ship more iron ore to China in 2020

Brazil’s Vale SA expects iron ore shipments to China to rise in 2020, versus 2019, due to falling demand in other countries hurt by the coronavirus pandemic, according to a phone call between the miner and the China Iron and Steel Association. Production at Vale has not been impacted by the pandemic and it is …

Continue reading “Vale expected to ship more iron ore to China in 2020”

Capesize July 20 Morning Technical Comment – 240 Min

Iron ore consolidation points to potential reversal

Ferrous Sector Money-flow: DCE iron ore aggregated open interest reached a high at 1.18 million lots on February 21 as well as creating periodic high, following a correction of 19.26%. The open interest high last week was 1.15 million lots. Long positions need to be aware of the similar correction happen for the second time …

Continue reading “Iron ore consolidation points to potential reversal”

Capesize v Panamax Q4 20 Spread

Capesize v Panamax Q4 20 Spread To view the full report please click on the link