Capesize market slowed after the recent rally in shipping rates, as trade sources seek for clearer market direction ahead. As such, the Capesize 5 time charter average slid slightly by $56 to $4,140 on Friday, as the market approached the long weekend. There was a prompt selloff of June contracts earlier in trading session, before …

Tag archives: CS

Capesize rates drive higher by iron ore prices

Capesize market moved up to higher on higher iron ore prices and robust shipping demand. Due to the stronger physical market, the Capesize 5 time charter average rose by $245 to $4,196 on Thursday. The strong freight market had reflected a surge in iron ore prices which had hovered above the $90/mt for almost two …

Continue reading “Capesize rates drive higher by iron ore prices”

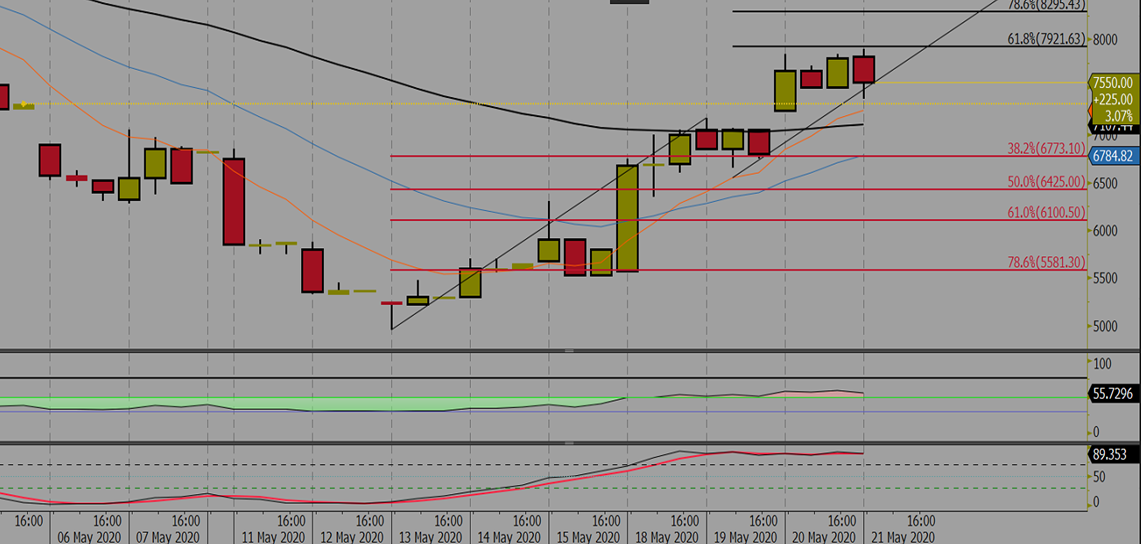

Capesize June 20 Morning Technical Comment – 240 Min

China Abandons Hard Growth Target, Shifts Stimulus Focus to Jobs

The Chinese government abandoned its decades-long practice of setting an annual target for economic growth amid the storm of uncertainty unleashed by the coronavirus pandemic, and said it would continue to increase stimulus. Speaking at the National People’s Congress in Beijing on Friday morning, Premier Li Keqiang delivered an annual policy address that instead laid …

Continue reading “China Abandons Hard Growth Target, Shifts Stimulus Focus to Jobs”

Capesize June 20 Morning Technical Comment – 240 Min

Robust Pacific drives Capesize rates higher

Capesize market continued the good run, thanks to the robust Pacific market with better freight rates. Reflecting the better physical market, the Capesize 5 time charter average increased by $489 to $3,951 on Wednesday. With Capesize market as the driving force, the Baltic Dry Index spiked again and gained over 5.30% on-day to 477 readings …

Continue reading “Robust Pacific drives Capesize rates higher”

What to Watch as China Unveils Stimulus in Policy Meeting

China’s top leaders should reveal on Friday how much they’re planning to spend on stimulus to support the post-virus economy, when they belatedly announce their economic policy blueprint for the rest of 2020. The centerpiece event will be the work report delivered by Premier Li Keqiang, which typically contains the economic growth and spending targets, …

Continue reading “What to Watch as China Unveils Stimulus in Policy Meeting”

China Simplifies Iron Ore Import Rules Amid Australia Virus Spat

China streamlined its inspection rules for iron ore imports amid increasing debate about whether the $43 billion trade between the two nations will be caught up in their escalating spat. While the Global Times — a tabloid run by the flagship newspaper of the Communist Party — said the simplification of rules is aimed at …

Continue reading “China Simplifies Iron Ore Import Rules Amid Australia Virus Spat”

Capesize continues the good run with better demand

Capesize market rebound to better shipping demand, with improving freight rates in both the Atlantic and Pacific basins. Thus, the Capesize 5 time charter average rose by $587 to $3,462 on Tuesday, as some trade participants believed that the market had bottomed out. Buoyed by the better Capesize market, the Baltic Dry Index rose over …

Continue reading “Capesize continues the good run with better demand”