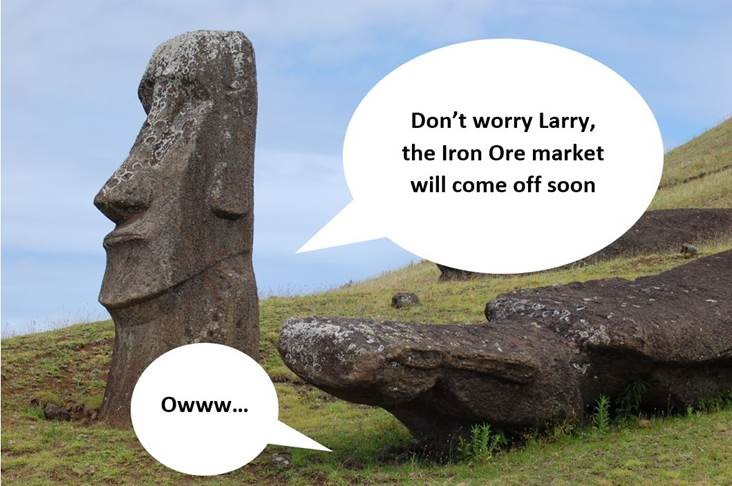

FIS Castaway Podcast – Episode 49 Post Easter trading regrets? Don’t worry, get an update on what’s happening in the Freight, Iron Ore and Oil markets on this week’s podcast. Listen Below: Website https://freightinvestorservices.com/blog/fis-castaway-eps-49/ Spotify https://open.spotify.com/episode/2SootYMgBfXagWDL5Um0YJ?si=t1roN1z_RmWdlq_LVdx4kA iTunes https://podcasts.apple.com/gb/podcast/episode-49/id1507094242?i=1000516140468 Disclaimer: This podcast is a marketing communication and is …

Continue reading “FIS Castaway Podcast – Episode 49 07/04/21”