It is one of the best-known Beatles songs from their final studio album Let It Be, but it also encapsulates perfectly the challenge many commodity markets face as they begin to recover from the enormous disruption of Coronavirus. The pandemic has impacted every metric you can think of: quantitative easing, government debt, unemployment, share …

Tag archives: IO62

DCE flats on low port inventory

Chinese futures changed little as the market tried to end the week on positive note with huge drawdown of port inventory. Thus, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, rose slightly by 0.13% day-on-day to RMB 768 per tonne on Friday. Likewise, the steel rebar contract on …

DCE drops for the second day on easing Brazilian supply

Chinese futures slid for the second consecutive day due to supply easing as Vale reopened its Itabira complex. As such, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, dropped by 1.03% day-on-day to RMB 765 per tonne on Thursday. However, the steel rebar contract on the Shanghai Futures …

Continue reading “DCE drops for the second day on easing Brazilian supply”

Iron Ore DCE September Daily Technical Review Jun 18th(Daily Chart from Mar 10th to Jun 18th)

Verdict – Short-term neutral. DCE iron ore consolidate for few days and correct during today. The highs are becoming lower at 798.0,788.0,786.5. The lows are becoming higher 733.5,756.5,764.0. In short-run, iron ore traded in a triangle and narrowing in the consolidating range. From hourly chart, MACD widened below 0 axis after dead cross. Slow stochastic …

FIS Daily Physical Review Jun 18th

Iron Ore and Steel Market Updates Vale informs that, on this date, the Sub-Secretariat for Labour Inspection, in Minas Gerais, issued a Term of Suspension of Interdiction of the Itabira mining complex. The Itabira Complex activities were halted since June 5th, 2020 and the production impact was lower than 1 Mt. The operation will be …

Iron ore rebound capped on COVID rebound fears

Iron ore futures rebounded on Wednesday but was capped around $101 as investors kept a worried eye over the latest Coronavirus situation in China. Beijing stepped up its containment efforts following a cluster of new cases in Beijing and triggered a selloff yesterday afternoon as investors were worried of a second wave of cases. …

Continue reading “Iron ore rebound capped on COVID rebound fears”

FIS Technical – DCE Iron Ore Sep 20 Testing Trend Support

FIS Technical – DCE Iron Ore Sep 20 Testing Trend Support To view the full report please click on the link

Capesize July 20 Morning Technical Comment – 240 Min

DCE corrects amid second wave of coronavirus

Chinese futures faced a correction on Wednesday after a recent rebound, due to market concerns over second wave of coronavirus in Beijing. Thus, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, dropped by 1.22% day-on-day to RMB 766.50 per tonne on Wednesday. Meanwhile, the steel rebar contract on …

Continue reading “DCE corrects amid second wave of coronavirus”

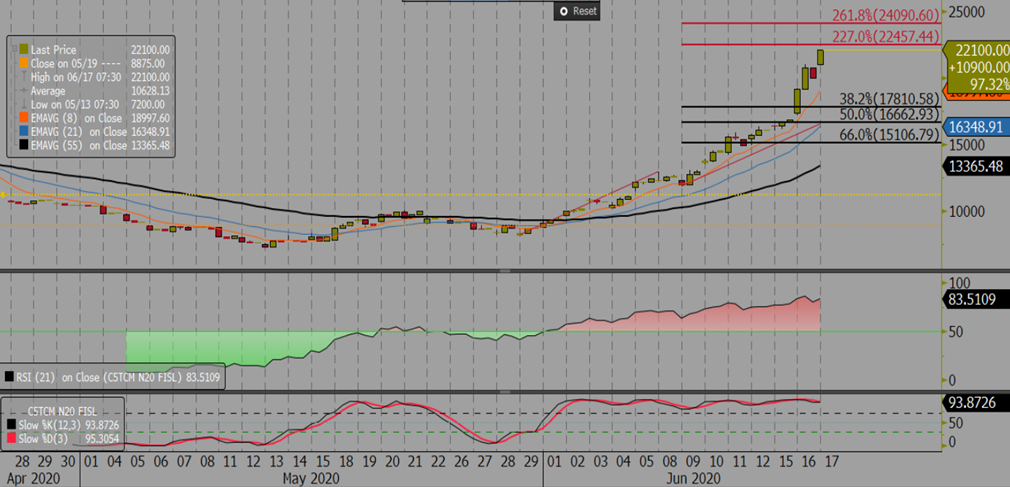

Iron Ore DCE September Daily Technical Review Jun 17th(Hourly Chart from Apr 20th to Jun 17th)

Verdict – Short-term neutral. DCE iron ore consolidate for few days and correct during today. The highs are becoming lower at 798.0,788.0,786.5. The lows are becoming higher 733.5,756.5,764.0. In short-run, iron ore traded in a triangle and narrowing in the consolidating range. From hourly chart, MACD widened below 0 axis after dead cross. Slow stochastic …