Chinese futures closed the week on positive note after a rally at afternoon session as China’s port inventory dropped to the lowest level in four years. Thus, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, rose by 1.90% day-on-day to RMB 777 per tonne on Friday. The steel …

Tag archives: IO62

Iron Ore Offshore July 20 Morning Technical Comment – 240 Min Chart

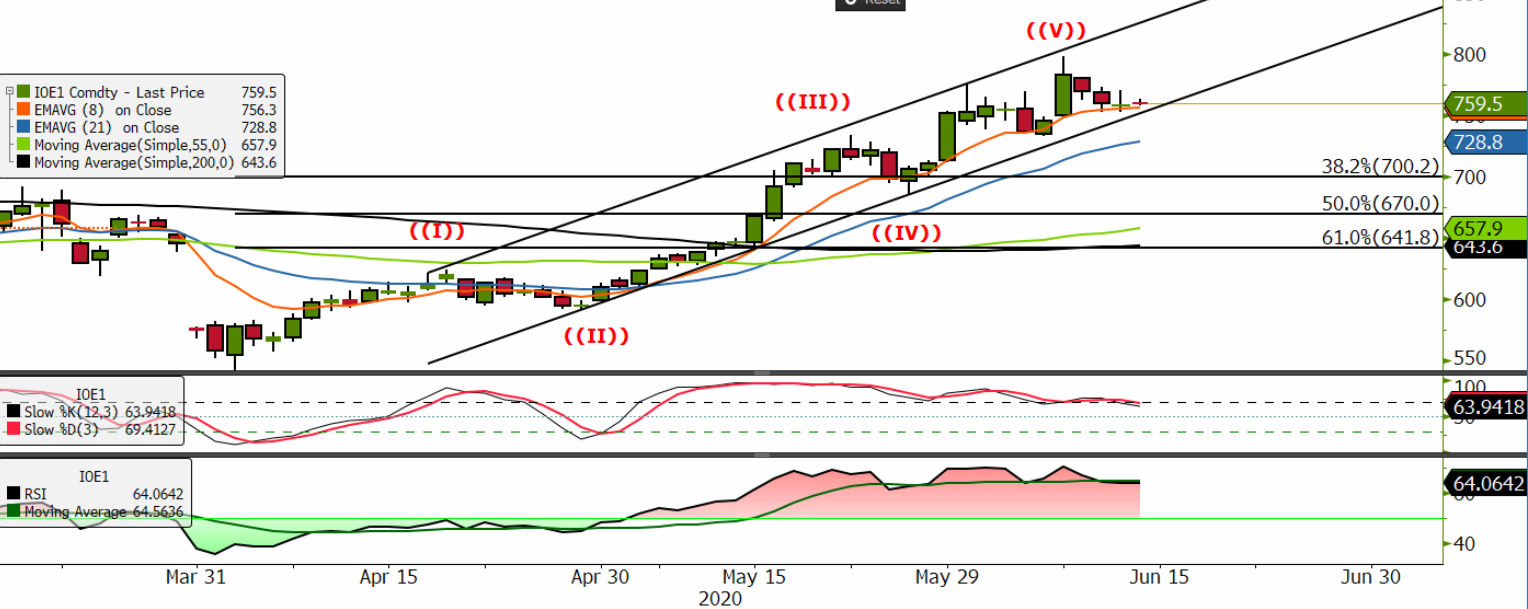

Iron Ore DCE September Daily Technical Review Jun 12th(Hourly Chart from Apr 22nd to Jun 12th)

Verdict – Short-term neutral. DCE iron ore rebounded with increasing volume and interest. However be aware of major trades are tend to be short-run. Iron ore tested low and strongly supported by 10 day moving average. The return to bull requires a breakthrough on 798.0, previous high. From hourly chart, MACD created gold cross. CCI …

FIS Daily Physical Review Jun 12th

Iron Ore and Steel Market Updates – China 45 ports iron ore inventories at 106.97 million tonnes, down 560,000 tonnes w-o-w. Australia iron ore port inventories 61.29 million tonnes, up 780,000 tonnes w-o-w. Brazil iron ore 20.71 million tonnes, down 1.07 million tonnes w-o-w. – Mysteel researched 247 blast furnace operation rate at 91.67%, up 0.65% …

FIS Technical – DCE Iron Ore Sep 20

FIS Technical – DCE Iron Ore Sep 20 To view the full report please click on the link

DCE flattens amid rainy season

Chinese futures remained almost flat on limited market activity as buyers prepared for lower steel demand during rainy season. As such, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, dipped slightly by 0.59% day-on-day to RMB 759 per tonne on Thursday. Similarly, there was not much movement in …

FIS Daily Physical Review Jun 11th

Iron Ore and Steel Market Updates MySteel sintered iron ore inventory at 16.62 million tonnes. Sintered iron ore daily consumption 625,100 tonnes. Inventory turnover in 23 days. China weather forecast indicated heavy rain and flood warning in western, mid-China and southern provinces. Guangzhou inventories decrease slower w-o-w, since several floods happen in late May and …

Iron ore softer as pundits exchange views on supply outlook

Iron ore futures were a touch softer on Wednesday as investors assessed the supply outlook for iron ore following the recent closure of Vale’s Itabria complex. Investors grew concerned over tight supply after Vale was ordered to shut down Itabria, which accounts for over 10% of Vale’s output, in the state of Minas Gerais …

Continue reading “Iron ore softer as pundits exchange views on supply outlook”

DCE slides for second day on cautious buying

Chinese futures dropped on limited buying interest as procurement slowed down and buyers digested high prices and supply impact in the market. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, continued to descend for the second consecutive day by 1.43% day-on-day to RMB 759.50 per tonne on Wednesday. …

Continue reading “DCE slides for second day on cautious buying”

Iron Ore DCE September Daily Technical Review Jun 10th(Hourly Chart from May 18th to Jun 10th)

Verdict – Short-term neutral to bearish. DCE iron ore broke the previous gap and thus lose an important support around 760.0 level. However daily low tested low at moving average 10 and bounced back. The mid-run correction has yet come. From hourly chart, if iron ore broke 733.5 then top reversal in mid-run created. Hourly …