Iron Ore and Steel Market Updates – Iron ore port fixed-price trades are light during past two days. – Australia Pilbara port may export 47.78 million tonnes, up 3.4% y-o-y, export to China 43.18 million tonnes, up 14.14%. – Ganggu Construction Steel Inventory: production 2.11 million tonnes, up 2.45% w-o-w. Mills inventory 2 million tonnes, …

Tag archives: IO62

China steel imports boom, exports dip, iron ore softer

Iron ore futures were a touch softer on Tuesday as investors assessed outlook for iron ore. China imported 1.25 million mt of finished steel in May, up 27.2% month-on-month or up 30.3% year-on-year, according to customs data. During the same period, China’s finished steel exports fell by 30.4% month-on-month or 23.4% to 4.4 million …

Continue reading “China steel imports boom, exports dip, iron ore softer”

DCE retreats from more Australian exports

Chinese futures retreated slightly today after a recent rally that supported by possible supply concerns in Brazil. As such, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, dropped by 1.03% day-on-day to RMB 769.50 per tonne on Tuesday. Following the decline, the steel rebar contract on the Shanghai …

Continue reading “DCE retreats from more Australian exports”

Iron Ore Offshore July 20 Morning Technical Comment – 240 Min Chart

FIS Ferrous Weekly Report 09/06/2020

Iron ore breaks $100 as Vale shuts in production capacity

Iron ore futures surged above $100 on Monday after part of Vale’s Brazilian operations were ordered to be shut down due to the Coronavirus. Prosecutors had alleged that workers were at risk at the mine complex of Itabira in the state of Minas Gerais after 188 of them were tested positive. The latest development …

Continue reading “Iron ore breaks $100 as Vale shuts in production capacity”

DCE rises over Vale’s supply woe

Chinese futures rose further over supply concerns as Vale was ordered to suspend its Itabira mine amid coronavirus pandemic. Thus, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, jumped up by 5.53% day-on-day to RMB 783 per tonne on Monday. However, the steel rebar contract on the Shanghai …

Iron Ore Offshore July 20 Morning Technical Comment – 240 Min Chart

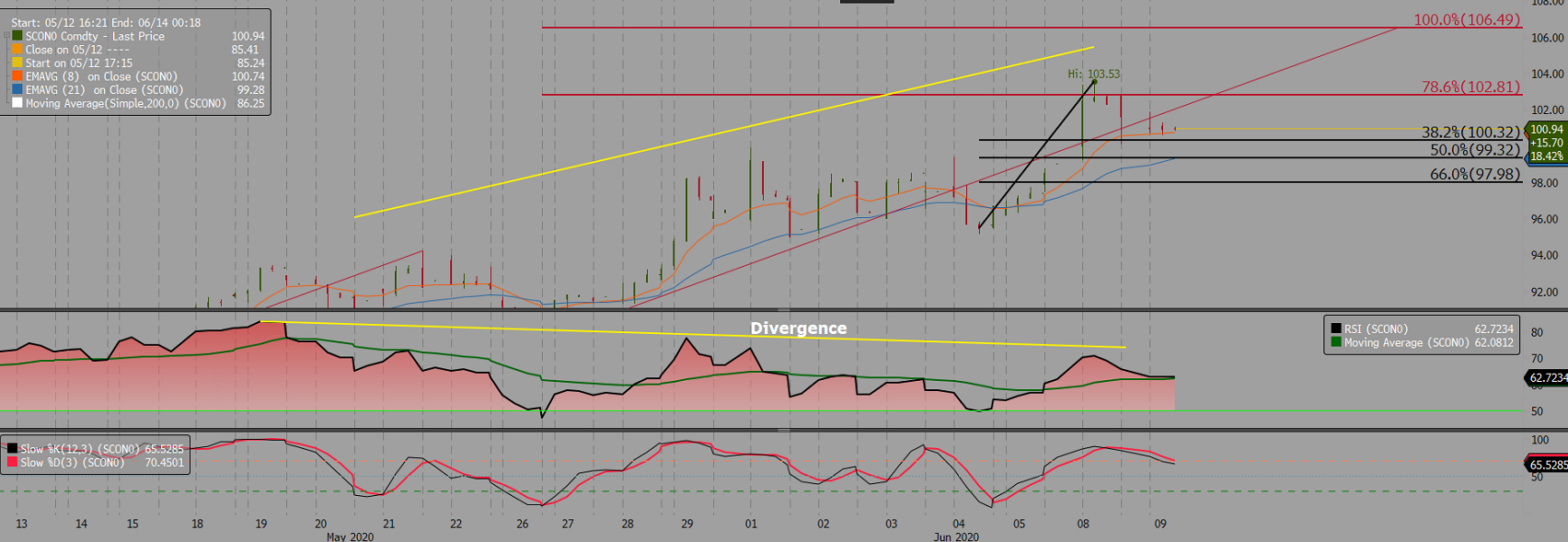

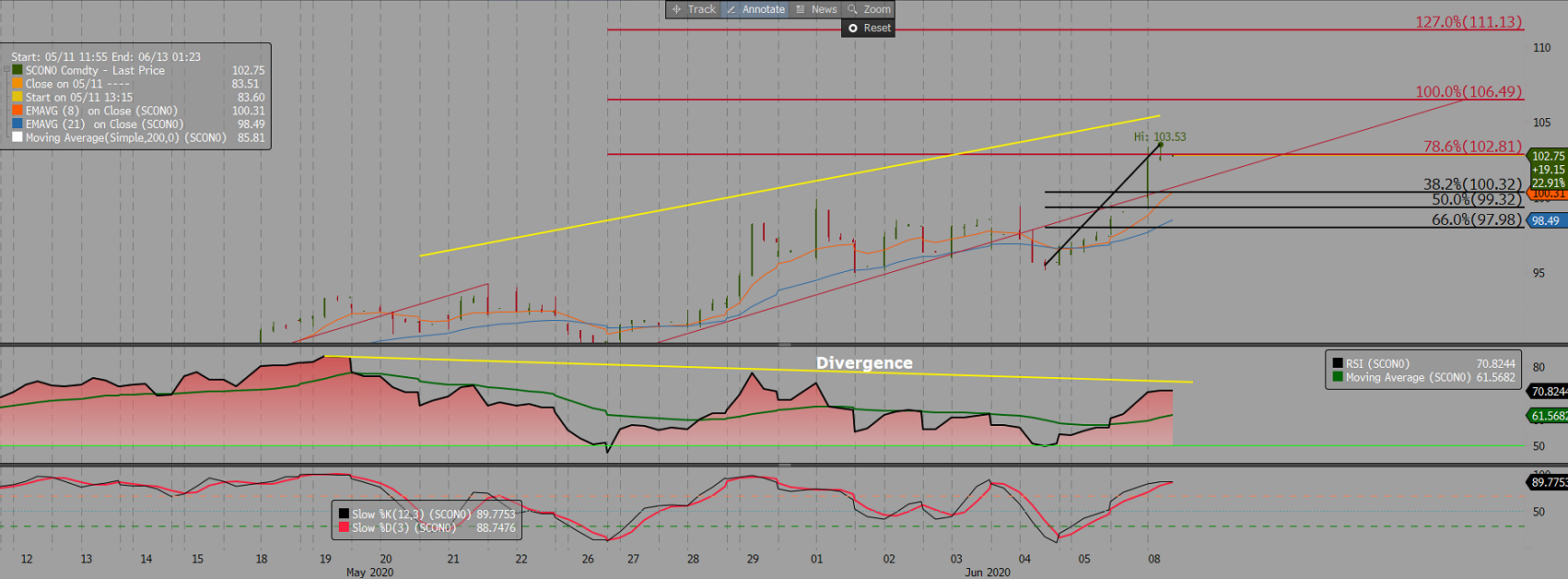

Iron Ore DCE September Daily Technical Review Jun 8th(Hourly Chart from May 18th to Jun 8th)

Verdict – Short-term consolidation. DCE iron ore jumped up at 798.0 yuan only 3 yuan from limit up however correct back significantly by last hour and closed at 783.0 yuan. From hourly chart slow stochastic narrowed and potentially create dead cross near overbought area. Hourly level CCI correct from high area. Technical signals are indicating …

FIS Daily Physical Review Jun 8th

Iron Ore and Steel Market Updates – Steelbank inventories: construction steel inventories 7.08 million tonnes, down 5.51% w-o-w. HRC inventories 2.08 million tonnes, down 5.88% w-o-w. – China customs: China iron ore import 87.03 million tonnes in may, up 3.9% y-o-y. China steel export 4.4 million tonnes in may, down 23.4% y-o-y. – Vale informed …