https://freightinvestorservices.com/wp-content/uploads/2020/05/FIS-MorningTechnical-Iron-Ore-Offshore-28-05-20.pdf

Tag archives: IO62

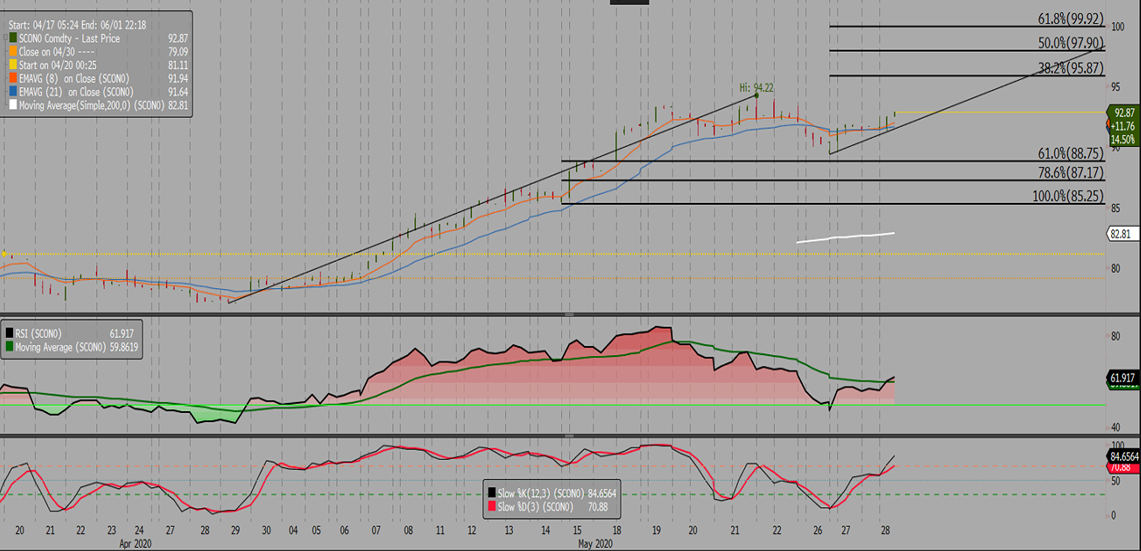

Iron Ore DCE September Daily Technical Review May 28th(Hourly Chart from Arp 3rd to May 28th)

Verdict – Short-term neutral. DCE iron ore consolidate and rebound during the day. Short-run entered a new platform from 700.0 -713.0. From hourly chart, 713.0 was the neckline previously, as well as an intraday resistance. Iron ore aggregated interest flats and fewer changing hands also caused much smaller volume. Hourly CCI was strong. MACD gold …

FIS Daily Physical Review May 28th

Iron Ore and Steel Market Updates – Australia Anti-Dumping Commission start to investigate on imported colored steel belt from China and Vietnam. The investigation period from April 1st,2019 – March 31st, 2020. – MySteel Rebar Inventory: Rebar production 3.94 million tonnes, up 0.63% w-o-w. Mills inventory 3.05 million tonnes, up 1.38% w-o-w. Circulation inventory 8.03 …

Iron ore futures surge on Brazil virus fears

Iron ore futures surged on Wednesday on renewed concerns over the worsening coronavirus crisis in Brazil. Unlike many other countries, Brazil has not enforced a lockdown, resulting in a widespread increase of coronavirus infections. It was reported that there has been a sudden spike in coronavirus cases in the Brazilian state of Para, where around …

Continue reading “Iron ore futures surge on Brazil virus fears”

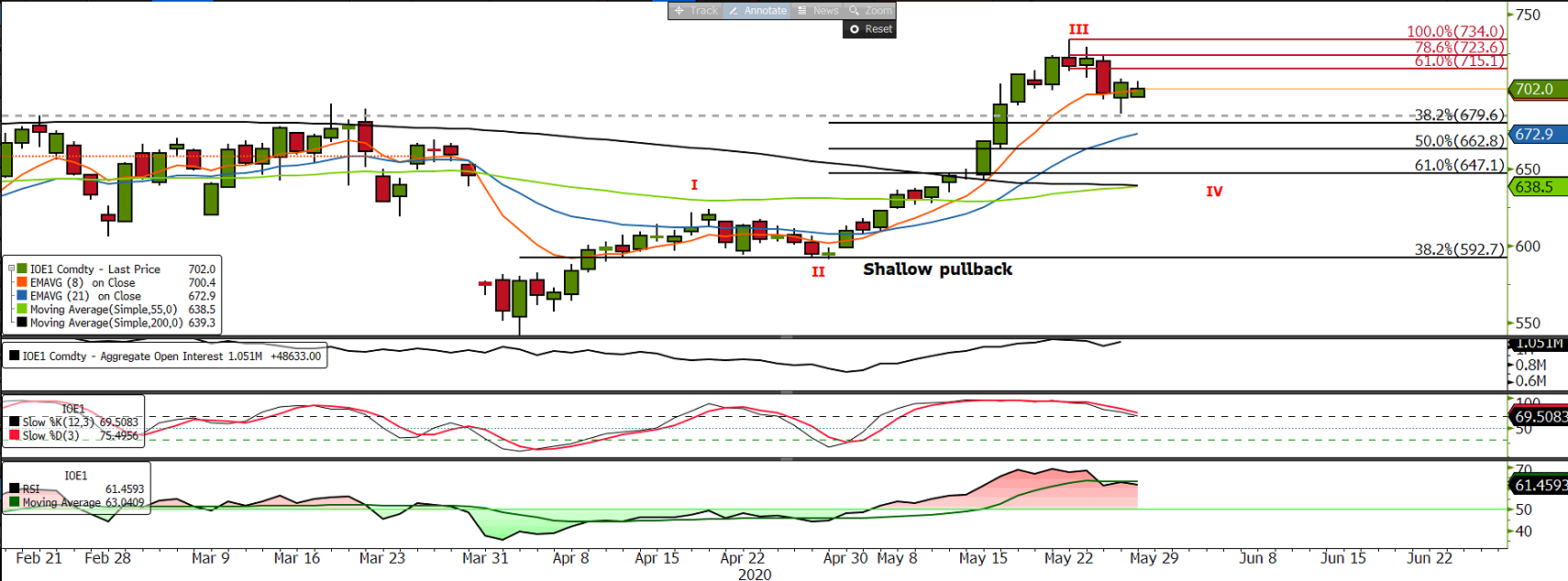

FIS Technical – DCE Iron Ore Sep 20

FIS Technical – DCE Iron Ore Sep 20 The futures remain technically bullish having made a higher high in the market with price above the 8—21 period EMA’s. This is supported by the RSI which remains above 50, however the stochastic is in overbought territory To view the full report please click on the link …

FIS Weekly Comment: Slow and steady growth for China after Two Sessions

One thing that stuck out of China’s Two Sessions is that Beijing policymakers had stopped setting GDP growth target but instead using various macroeconomic goals. Thus, no GDP growth numbers of 6% was mentioned in the Two Sessions as per previous session that we are used to. Instead, quantitative macroeconomic goals were set such as …

Continue reading “FIS Weekly Comment: Slow and steady growth for China after Two Sessions”

Last minute rally fails to spur DCE

Chinese futures dipped slightly despite a last-minute rally to pull the paper market from the trading lows of previous day. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, dipped by 0.07% day-on-day to RMB 706 per tonne on Wednesday. Similarly, the steel rebar contract on the Shanghai Futures …

Iron Ore DCE September Daily Technical Review May 27th(Hourly Chart from Arp 3rd to May 27th)

Verdict – Short-term neutral. DCE iron ore tested low at 685.5 for three times and then rebound through Asian hours. However, from daily chart iron ore is walking on a correction tunnel. From hourly chart, CCI has rebounded. Slow stochastic KD created gold cross in Asian morning. Short-term potentially test high. The first support is …

Iron Ore Drops on Supply Outlook, U.S.-China Tensions

Iron ore futures extended losses as investors focus on the outlook for supply, while deepening strains between China and the U.S. hang over global markets. “Iron ore shipments have increased significantly recently, while port inventories remain at a low level despite the slight rise in volume,” Huatai Futures said in a note. Although supply has …

Continue reading “Iron Ore Drops on Supply Outlook, U.S.-China Tensions”

FIS Daily Physical Review May 27th

Iron Ore and Steel Market Updates – Japan JFE steel will settle the subsidiary Nippon EGalv Steel in Malaysia after a financial loss. The mill will stop operation in this June. – Baffinland Iron Mines will keep operating at 6 million tonnes mtpa before the end of 2021. Indian Sponge Iron Manufacturers Association appealed to …