Tag archives: IO62

Iron ore futures fall as higher shipments ease supply fears

Iron ore futures were softer on Tuesday as data showing higher shipments from Australia and Brazil eased off supply concerns. According to data by Mysteel, shipments from Australia and Brazil were up by 4.08 million tonnes from a week earlier to 26.03 million tonnes. Furthermore, port overhauls in Australia and Brazil was completed on …

Continue reading “Iron ore futures fall as higher shipments ease supply fears”

DCE slides as participants seek clearer direction

Chinese futures continued the downward slope since the start of the week, as market participants waited for clearer market directions. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, dropped by 2.99% day-on-day to RMB 698.50 per tonne on Monday. Similarly, the steel rebar contract on the Shanghai Futures …

Continue reading “DCE slides as participants seek clearer direction”

High volatility expected, but iron ore risks reversal

Ferrous Sector Money-flow: DCE iron ore started to soften after open interest reached a yearly-high, indicating previous longs are taking gains. Coke became the leader of ferrous sector during previous week and early this week. DCE September iron ore total contract value was 65 billion Yuan, the peak in 2019 was 75 billion yuan. However, …

Continue reading “High volatility expected, but iron ore risks reversal”

Slight gains for DCE as market wait for clearer directions from Two Sessions

Chinese futures ended the week on slight gains as trade participants waited for further market direction from China’s Two Sessions. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, gained slightly by 0.77% day-on-day to RMB 716.50 per tonne on Friday. On the contrary, the steel rebar contract on …

Continue reading “Slight gains for DCE as market wait for clearer directions from Two Sessions”

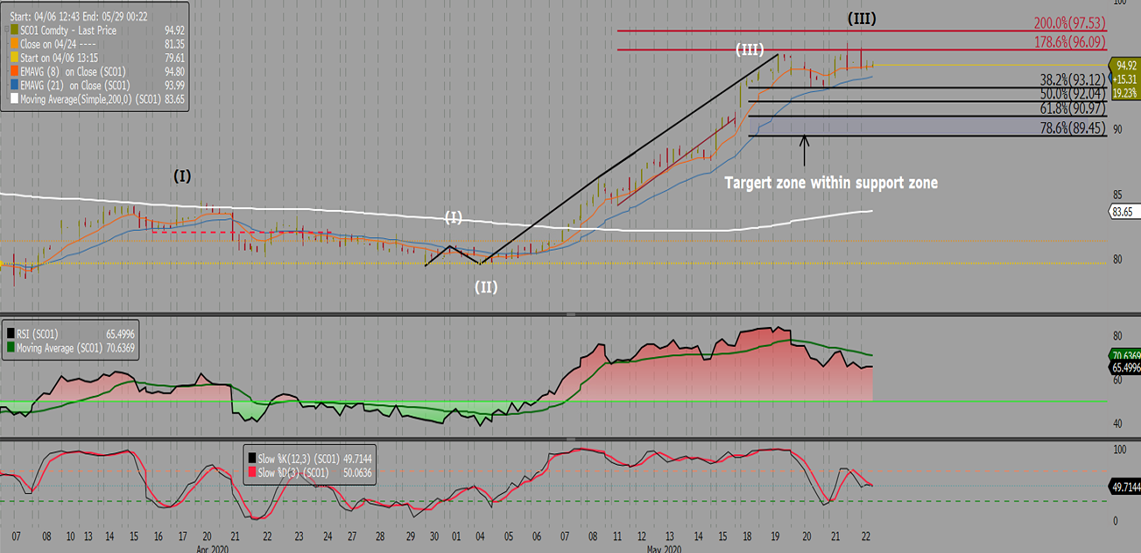

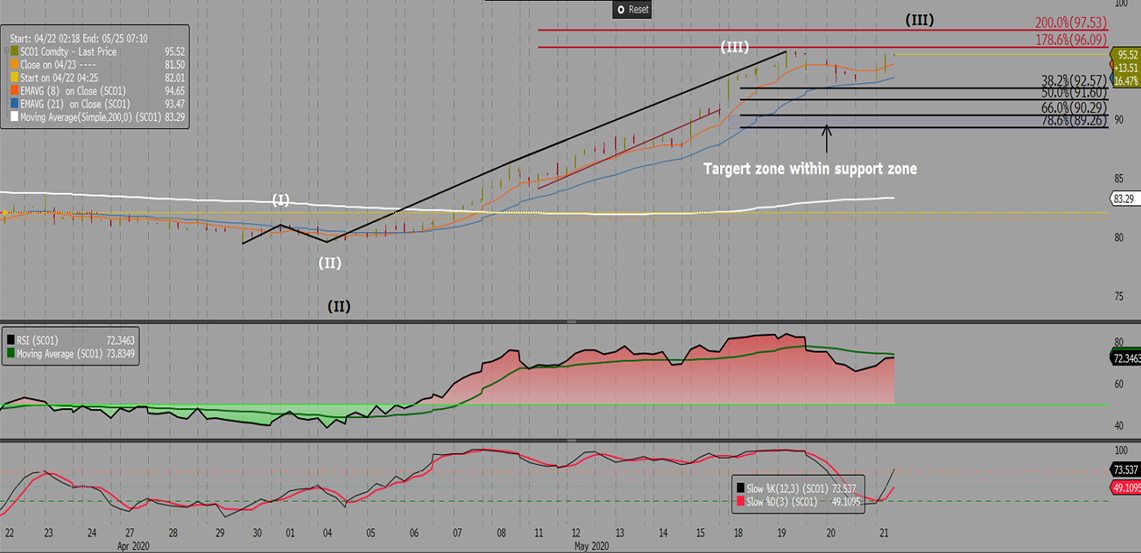

Iron Ore Offshore June 20 Morning Technical Comment – 240 Min Chart

The only way is up

The question that comes up more and more is when will we get a turnaround in the markets? This, of course, is the question on the lips of everyone from big fund traders all the way to small IG Index punters. At face value, it seems that for many markets the only way is up. …

Iron ore blips back on supply fears, stimulus hopes

Iron ore futures recovered from yesterday’s blip to trade above $95 as investors become increasingly concerned over the coronavirus crisis in Brazil. Brazil’s iron ore shipments had their slowest start to a year in the last five years. Brazilian miner Vale downgraded its production guidance early in the year, Morgan Financials Ltd noted that more …

Continue reading “Iron ore blips back on supply fears, stimulus hopes”

DCE on a bull run over anticipation of stimulus packages

Chinese futures spiked up further, over tight supply concerns and expectation of more Chinese stimulus measures. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, jumped by 2.05% day-on-day to RMB 722 per tonne on Thursday. On the contrary, the steel rebar contract on the Shanghai Futures Exchange increased …

Continue reading “DCE on a bull run over anticipation of stimulus packages”