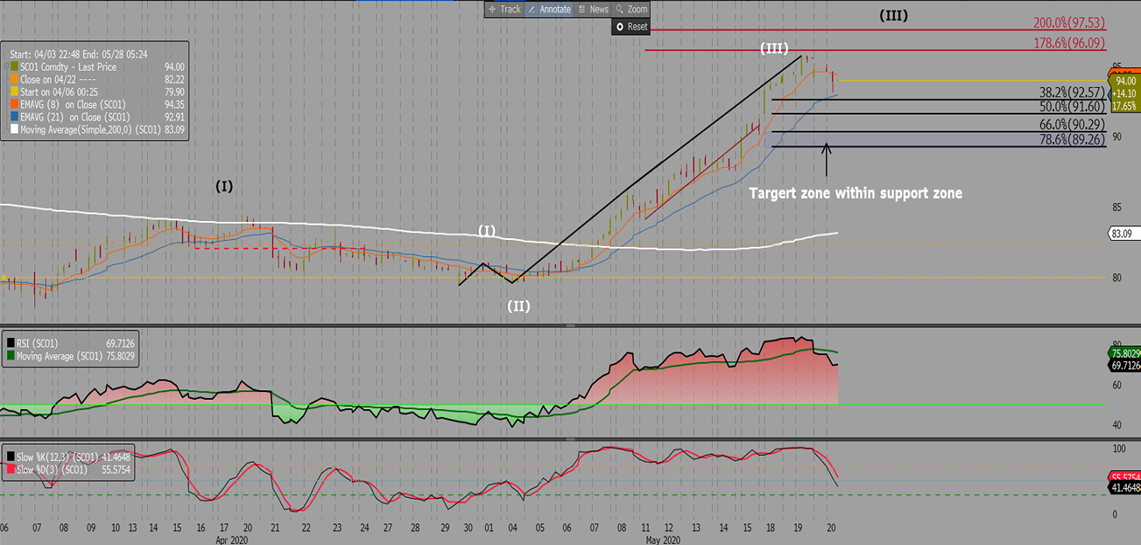

Iron ore futures retreated on Wednesday ahead of China’s Two Sessions meeting which is scheduled to convene tomorrow. Some profit-taking activities could be attributed to the decline as investors await the annual meeting for news of fresh impetus. Iron ore has enjoyed a stellar run of late, gaining over $13 since the start of …

Continue reading “Iron ore futures retreat as traders take profits ahead of Two Sessions”