Tag archives: PM

ShipShape: The Long and Winding Road

It is one of the best-known Beatles songs from their final studio album Let It Be, but it also encapsulates perfectly the challenge many commodity markets face as they begin to recover from the enormous disruption of Coronavirus. The pandemic has impacted every metric you can think of: quantitative easing, government debt, unemployment, share …

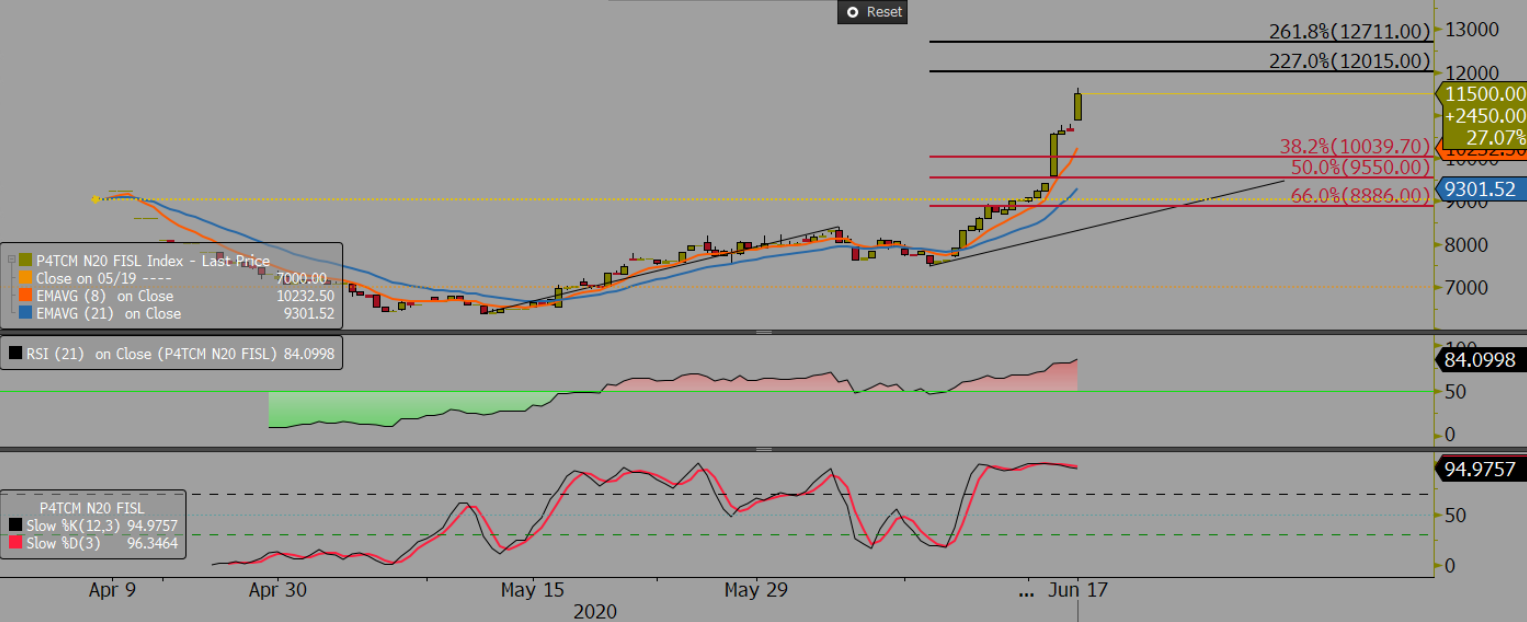

FIS Panamax Technical Report

FIS Panamax Technical Report The index is technically bullish having broken last weeks Fractal resistance. Near-term upside target is USD 9,601 with further resistance up to USD 11,315. Downside moves remain technically bullish above USD 6,934 and neutral below. To view the full report please click on the link

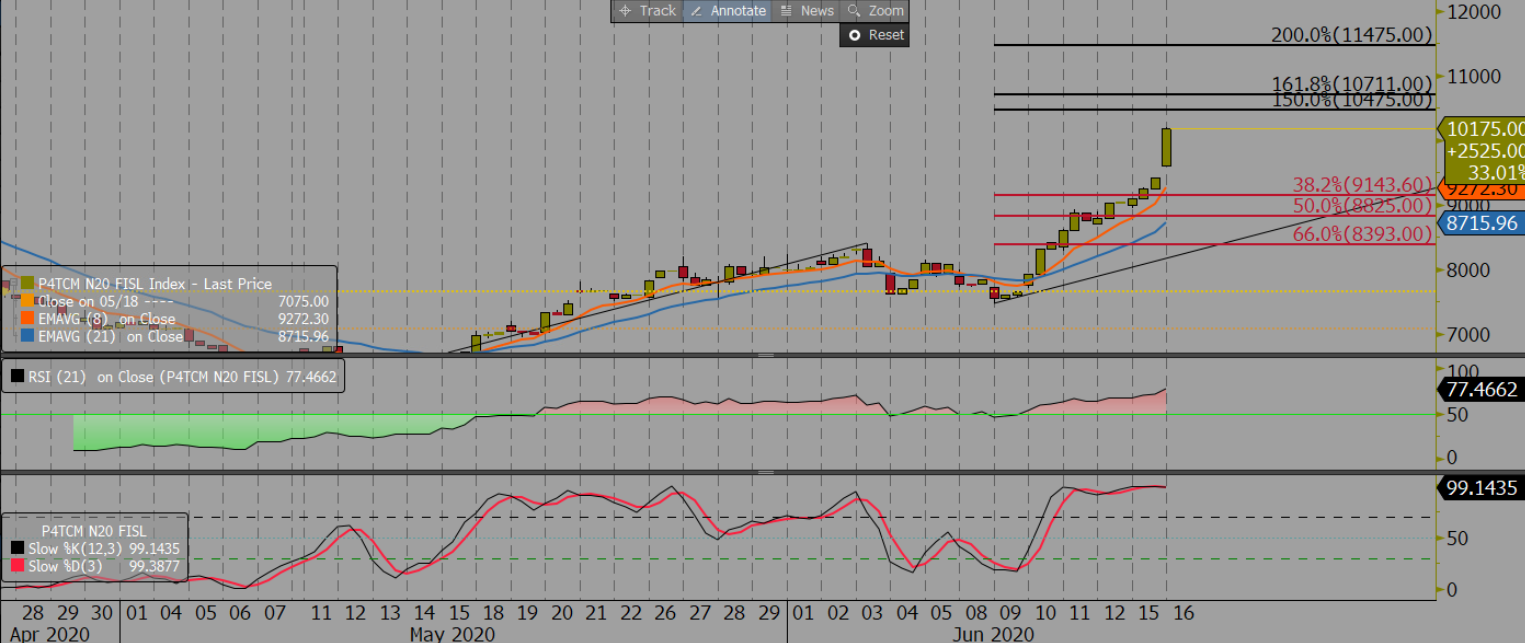

Panamax July 20 Morning Technical Comment – 240 Min

Panamax July 20 Morning Technical Comment – 240 Min

Panamax July 20 Morning Technical Comment – 240

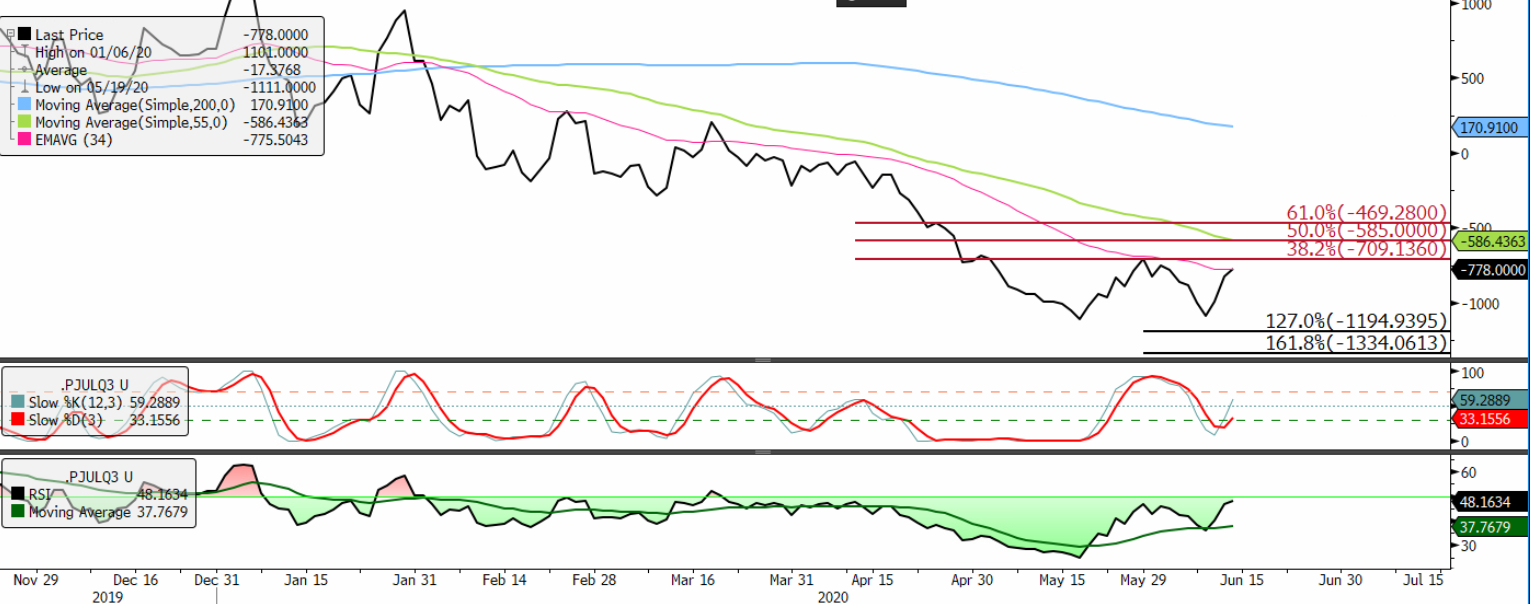

PMX Jul v Q3 20

PMX Jul v Q3 20 To view the full report please click on the Link

Panamax July 20 Morning Technical Comment – 240 Min

Panamax futures remain buoyant on China soybean purchases

Panamax futures remained buoyant this week as China continued to buy US Soybeans, despite increased political tensions over Hong Kong. The Q4 futures rallied 5.5% on Wednesday as the world’s second largest economy was revealed as purchasing 10 cargoes of soybeans this month from the U.S. alone, according to Bloomberg. China needs beans and remains …

Continue reading “Panamax futures remain buoyant on China soybean purchases”