Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. last week jobless claims filed at 230,000, est. 230,000, last 225,000.

• China November CPI up 1.6%, last 2.1%. China November PPI down 1.3%, down 1.3% last.

Iron Ore Key Indicators:

• Platts62 $110.70, +3.25, MTD $107.98. Brazil northern system rainy weather potentially has some impact on the IOCJ supply to market, indirectly tightened the BRBF market. The market saw continuous BRBF traded in fixed price from late last week. However on the background of weak steel margin in Asian blast furnaces, iron ore procurement has limited room. The mills in China were still cautious buying stocks, however physical traders hold positive outlook on the aftermarket.

• MySteel 45 ports iron ore inventories at 133.85 million tons, up 1.068 million tons w-o-w. Daily evacuation 3.03 million tons, up 36,800 tons w-o-w. Australia iron ore 61.36 million tons, up 634,500 tons w-o-w. Brazil iron ore 49.37 million tons, up 613,400 tons w-o-w. 103 ships at ports, up 12.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 8th)

• Futures 97,899,400 tons(Increase 105,100 tons)

• Options 80,866,800 tons(Increase 1,271,000 tons)

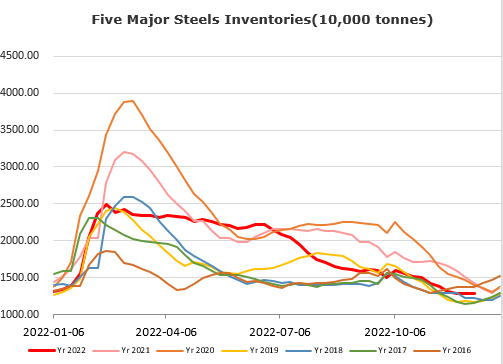

Steel Key Indicators:

• Major Chinese eastern steel mill, Shagang Group and Yonggang lowered heavy scrap price by 50 yuan/ton.

Coal Indicators:

• Australia FOB market maintained strong at $249-250, supported by the wet weather impact on eastern Australia PMV supply. There was 75,000mt Australia FOB HCCA Prime offer at $251/mt, failed to entice any bids yesterday however.