COVID-19 will haunt a generation. Be it from personal loss of friends or family members, loss of employment or the loss of an investment.

With nearly 8 million cases worldwide the pandemic has shown no sign of slowing down.

Global cases worldwide (source Bloomberg)

Infection cases may continue to rise, creating further havoc for both local and global economies. However, having been the first to be hit, we have seen the Chinese economy go from contraction to expansion, indicating that life goes on and a rebound is possible. China still have COVID-19, but it is controlled, with areas closed off after fresh outbreaks.

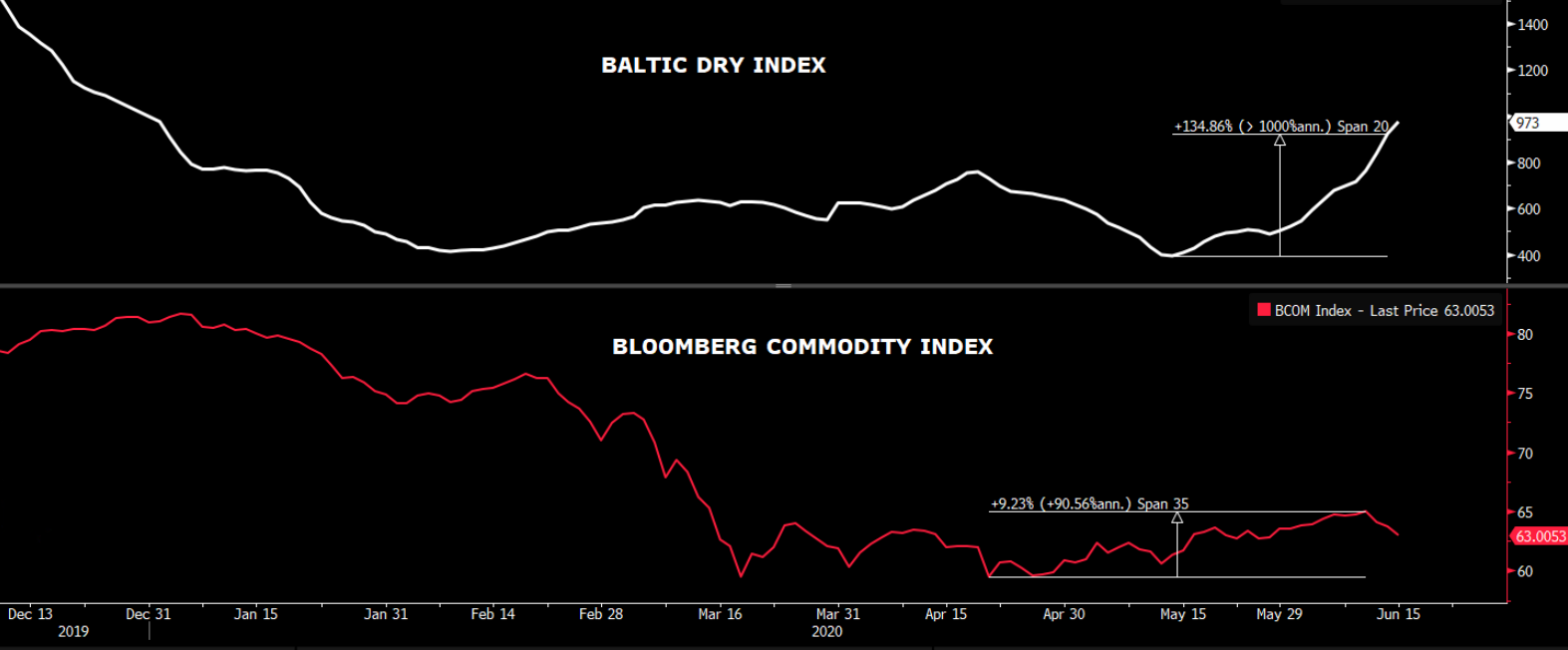

Stock markets have been the most resilient – in some analysis, overly optimistic. Having sold off aggressively the S&P 500 is now up 36% from its lows, whilst the Bloomberg Commodity (BCOM) index is only up 9%.

Part of this is purely down to investment, cash flow always moves fastest into undervalued stocks. The commodity index will have seen the slowdown in the transportation of goods and therefore oil demand and its drivers are more than just cold hard cash. It is up, but the rise will be naturally slower.

What the stock market is showing is a huge degree of optimism, given that it understands the reality of a disease which currently has no vaccine. But humanity did not stop due to Cholera, Tuberculosis or HIV, it adapted, it grew, and it thrived.

The Commodity index, like the global futures indexes will have wobbles, but ultimately humanity and COVID will learn to co-exist. The Bloomberg Commodity Index may be making a slow start, but with the Baltic Dry Index up 134% since the May 13th it is probably safe to assume that it is only a matter of time before we see a broader global recovery.

Baltic Dry Index vs Bloomberg Commodity Index (source Bloomberg)

If history teaches us anything it is that life goes on, regardless of the severity of the setback. COVID-19 is another of these and a major challenge, but one to which many parts of the world have mounted a successful response.

With China’s economy coming back online, interest in tracking and trading commodities will rebound as we look outwards rather than inwards. (FIS)